preface

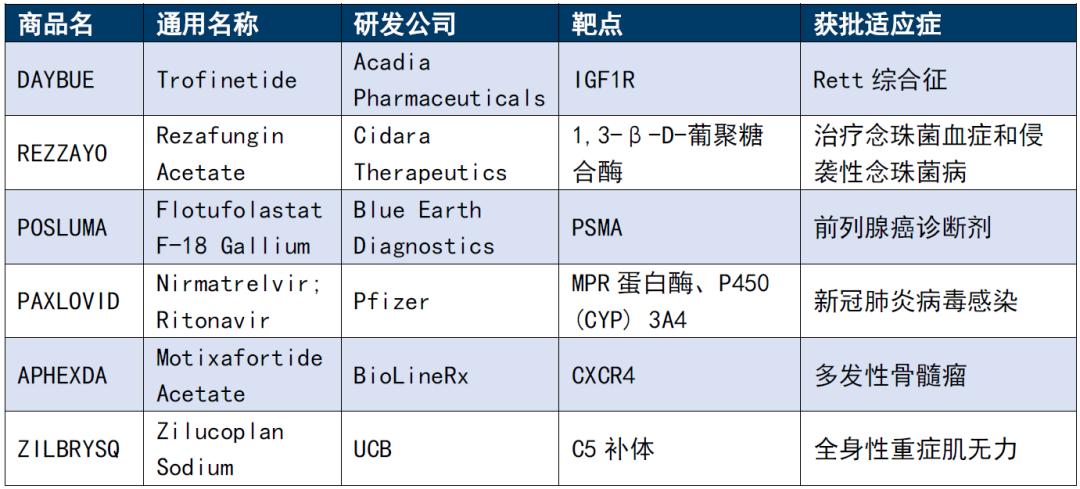

In 2023, the FDA approved 55 new molecular entity (NME) drugs, including six peptides, accounting for 11% of what CDER approved this year, a bumper year. In the field of treatment, two each in the field of anti-tumor (one for treatment; one for tumor diagnosis), anti-infection and rare diseases (Rett syndrome, systemic myasthenia gravis).

Table 1. Six new polypeptide drugs approved by FDA in 2023

Source: FDA official website, Kelaiying collation

· DAYBUE (trofinetide, trafeleptide) is a novel analog of IGF-1 amino-terminal tripeptide approved by the FDA in March 2023 for the treatment of Rite syndrome in children aged 2 years and older. This was a landmark event in the treatment of Rett syndrome, and during the approval process, the FDA awarded the titles of DAYBUE priority review, orphan drugs, and fast-track identification.

· REZZAYO (rezafungin) is a new echinocandin that acts by inhibiting β -1,3-glucose synthase and thus disrupting the integrity of the fungal cell wall, and also became the first new echinocandin to obtain FDA approval in more than a decade.

· POSLUMA (flotufolastat F 18) received FDA regulatory approval for PET of PSMA positive lesions on 25 May 2023 for suspected metastatic prostate cancer. It is the first FDA approved PSMA targeted imaging agent developed using proprietary radioactive hybridization techniques.

· PAXLOVID received the emergency use authorization from the FDA on December 22,2021 due to the outbreak, but the official approval date was May 25,2023. PAXLOVID contains two active ingredients nirmatrelvir and ritonavir, both of which are peptidomimetic substances. The two pepdomimetic peptides complement each other, creating the Paxlovid medical history status of "the sea crosses the sea".

· APHEXDA (motixafortide) was combined with filgrastim (G-CSF) to mobilize hematopoietic stem cells to peripheral blood for collection and subsequent autologous transplantation in patients with multiple myeloma. This is the first innovative stem cell mobilization drug approved in the United States in a decade for the treatment of multiple myeloma.

· ZILBRYSQ (zilucoplan) is FDA approved for the treatment of adult patients with systemic myasthenia gravis (gMG), positive for antiacetylcholine receptor (AChR) antibodies. The drug is a novel macrocyclic peptide C5 complement inhibitor administered once daily. In 2019, it was granted orphan drug status by the FDA, and on 1 December 2023, zilucoplan received approval from the European Commission for gMG.

PART 01

Global prospects of polypeptide drugs

Global

The advantages of polypeptide drugs are their high targeting and selectivity, and their relatively low toxic side effects. The polypeptide drugs approved by the FDA are mainly distributed in the seven major treatment areas of diseases, including rare diseases, tumors, diabetes, gastrointestinal tract, immunity, cardiovascular diseases, orthopedics and so on.

The top eight of the top 10 peptide drugs in the global market sales volume in 2022 were all drugs for diabetes or obesity, mainly GLP-1 receptor agonists. Smeaglutide, the highest sales company, had global sales of $10.914 billion in 2022, followed by dulaganeptide with $7.440 billion. In addition, GLP-1 (Smegallutide) has achieved excellent therapeutic results in diabetes and obesity-related heart failure (HF FpEF) and chronic kidney disease (CKD), and has been actively expanding indications such as Alzheimer's (AD) and non-alcoholic fatty liver disease (NASH). With the rapid growth of sales of GLP-1 polypeptide drugs such as simegallutide and Duraranotide, the global peptide drug market is expected to accelerate its expansion, ushering in the spring of polypeptide drugs.

Figure 1. Classification of drug therapy fields for marketed polypeptides

Source: Chinese Academy of Sciences venture capital, Kelaiying finishing

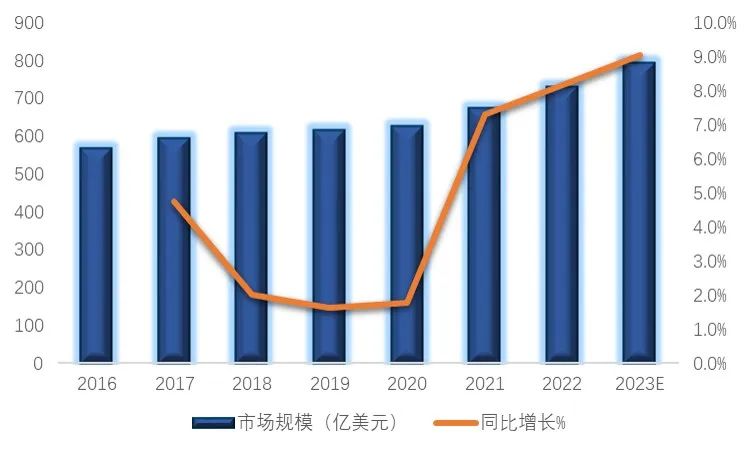

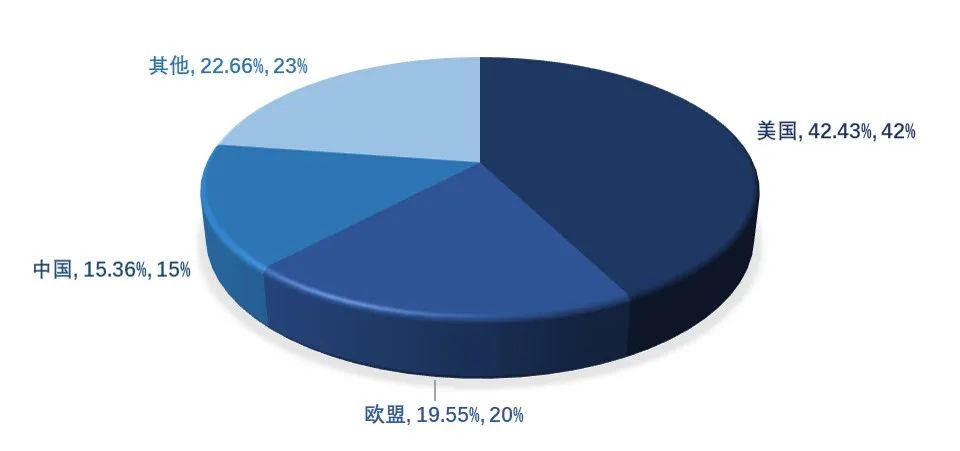

At present, there are about 180 peptide drugs approved in the world. In 2022, the global peptide drug market will reach $72.9 billion, and the global peptide drug market will reach $79.5 billion. In terms of regional distribution, the United States and Europe are the most important markets for peptide drugs, among which the United States accounts for 42.43%. As a new polypeptide drug, selmeaglutide has become a "popular" drug in 2023 with its excellent curative effect and broad market prospects.

As a star product of Novo Nordisk, it achieved a total sales of $21.201 billion in 2023, of which injection Ozempic (type 2 diabetes) generated $13.917 billion, up 60% year on year; tablet Rybelsus (Type 2 diabetes) earned $2.726 billion, up 66% year on year; and injection Wegovy (obesity) generated $4.557 billion, up 407% year on year. Behind this achievement is the rapid development of the polypeptide drug industry and the continuous breakthrough of technological innovation.

Figure 2. Size of the global polypeptide drug market

Figure 3. Global regional distribution of polypeptide drugs

Source: Zhiyan Consulting, Kelaiying sorting

PART 02

Market prospects of polypeptide drugs in China

Domestic

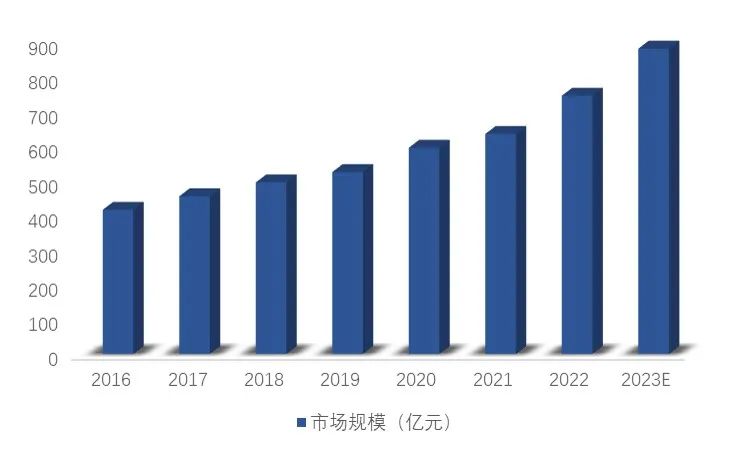

China peptide drug market product structure and the international mature market, the domestic sales of large peptide drugs mainly antitumor and immune regulation products, compared with the developed countries, China's peptide drugs in other market share is relatively small, as we encourage innovative drug research and development and promote generic drug consistency evaluation policy, in the future is expected to have more significant clinical effect of innovative peptide drugs and peptide generic drugs approved, make further peptide drug market in China.

China's polypeptide drug market increased from 41.58 billion yuan in 2016 to 59.5 billion yuan in 2020, with a compound growth rate of 9.37% during the period. It is expected that the market size of polypeptide drugs in China will reach 88.1 billion yuan in 2023.

Figure 4. Size of polypeptide drug market in China

Source: Frost & Sullivan, Soochow Securities Research Institute

brief summary

There are high barriers in the research and development and production of innovative polypeptide drugs, and downstream pharmaceutical companies tend to cooperate with professional polypeptide CDMO or API companies to achieve cost reduction and efficiency increase.

According to Frost & Sullivan data, the global polypeptide CDMO market size is expected to grow from $2.2 billion to $21.8 billion in 2021, CAGR 21%; China's polypeptide CDMO market is expected to grow from $1.3 billion to 18.5 billion yuan, and CAGR is 34%. Although the domestic polypeptide CDMO started late, it is expected to surpass the top overseas enterprises with its cost advantages and breakthroughs in technology and production capacity.

reference documentation

1. "Analysis of solid phase synthesis carrier and auxiliary materials industry for GLP ~ 1 peptide drugs, GLP ~ 1 peptide drugs can grow, solid phase carrier and purified materials are expected to benefit-231110", Nomura Orient International Securities, 2023.11

2. "Multi-function GLP-1 drug leads the development of the industry, Focus on the Upstream API sector", Ping An Securities, 2023.11