KRAS is destined to be a controversial therapeutic target, but its blockbuster deals have never been absent.

The controversy stems from two key developments: First, the KRAS G12C field has seen several high-profile deals, most notably BMS '$5.8 billion acquisition of Mirati Therapeutics. However, the world's first KRAS G12C inhibitor Lumakras underperformed post-launch, generating only $280 million in 2023 sales. Second, Revolution Medicines achieved a market capitalization exceeding $10 billion through its pan-KRAS inhibitor breakthrough for pancreatic cancer, positioning it as one of the biotech firms most likely to be acquired by multinational corporations.

So where are the next hot opportunities in KRAS? Recent deals point to KRAS G12D.

On August 12, Bayer and Kumquat Biosciences entered into a $1.3 billion contract agreement under which Bayer will receive global exclusive development and commercialization rights to Kumquat's KRAS G12D inhibitor, which received IND approval from the FDA in July 2025.

In 2023, China's KRAS G12D sector witnessed two landmark deals. Yousen Jianheng granted AstraZeneca a preclinical project (UA022) with a $24 million upfront payment plus a total contract price of up to $395 million. Meanwhile, Jinfang Pharma licensed three self-developed RAS pathway-targeting therapies—including GFH375—to Verastem Oncology for $625 million. These innovations have now demonstrated promising clinical data.

KRAS G12D may be the start of a new wave of BD/reBD.

01、KRAS G12D development opportunities

According to statistics, about 30% of cancer cases in the world are related to RAS gene mutation. Among them, KRAS cell signal pathway is a key molecular switch, and its mutation leads to cancer accounting for 85% of all RAS mutations. It is widely used in pancreatic cancer (90%), colorectal cancer (30-50%), non-small cell lung cancer (15-20%) and other cancers.

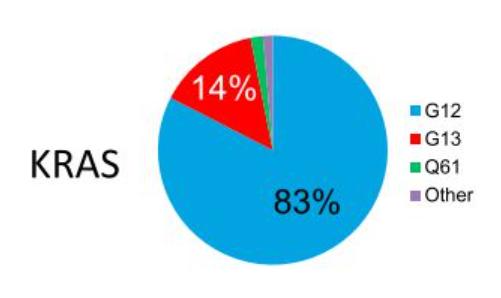

The most common KRAS mutation site was G12 (83% of all mutation sites), with the main types of mutations being G12D (33%), G12V (23%), G12C (11%), and G13D (12%).

In terms of mutation ratio, G12D has a higher mutation ratio than G12C; in addition, from the perspective of pattern observation, the competitive pattern of KRAS G12D inhibitors is different from that of KRAS G12C, which is heated up. At present, there are no KRAS G12D inhibitors on the market in the world, and there is still a lot of room for breakthrough.

KRAS G12C inhibitors only cover 11%-14% of all non-small cell lung cancer (NSCLC) patients and 3%-4% of all colorectal cancer patients. KRAS G12D mutations account for 36%-40% of all pancreatic ductal adenocarcinoma patients, 12%-13% of all colorectal cancer patients and 4% of all non-small cell lung cancer patients, as well as cholangiocarcinoma, ovarian cancer and others.

The KRAS G12D mutation is so concentrated in pancreatic ductal adenocarcinoma, the "king of cancer", that it has stimulated the market value of its potential targeted drugs.

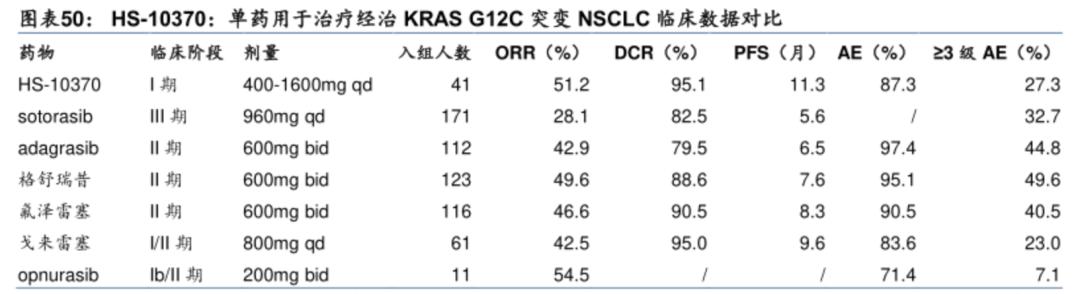

In terms of the competitive landscape, there are currently five KRAS G12C inhibitors approved worldwide and more than four in phase III clinical trials, which makes the subsequent KRAS G12C inhibitors in the non-small cell lung cancer market extremely competitive.

The fastest development pipeline of KRAS G12D inhibitors in the world is the pan-KRAS inhibitor of Revolution Medicines, while the fastest single-target KRAS G12D inhibitor is HRS-4642 of Hengrui. The other pipelines are in phase I/II or I, and it is not clear who will win in the future.

Some of these pipelines have released early clinical data to support further efficacy exploration.

02 、Navigator data

When it comes to KRAS G12D, the frontrunners are Hengrui Pharma and Revolution Medicines.

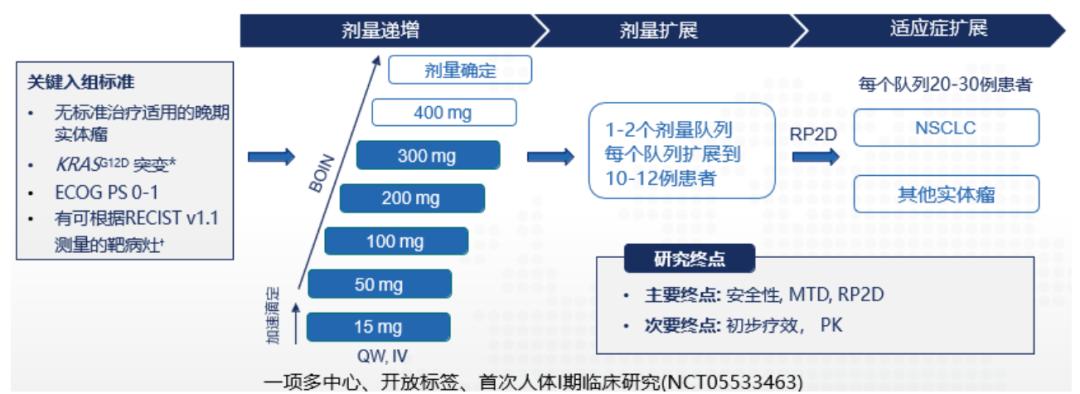

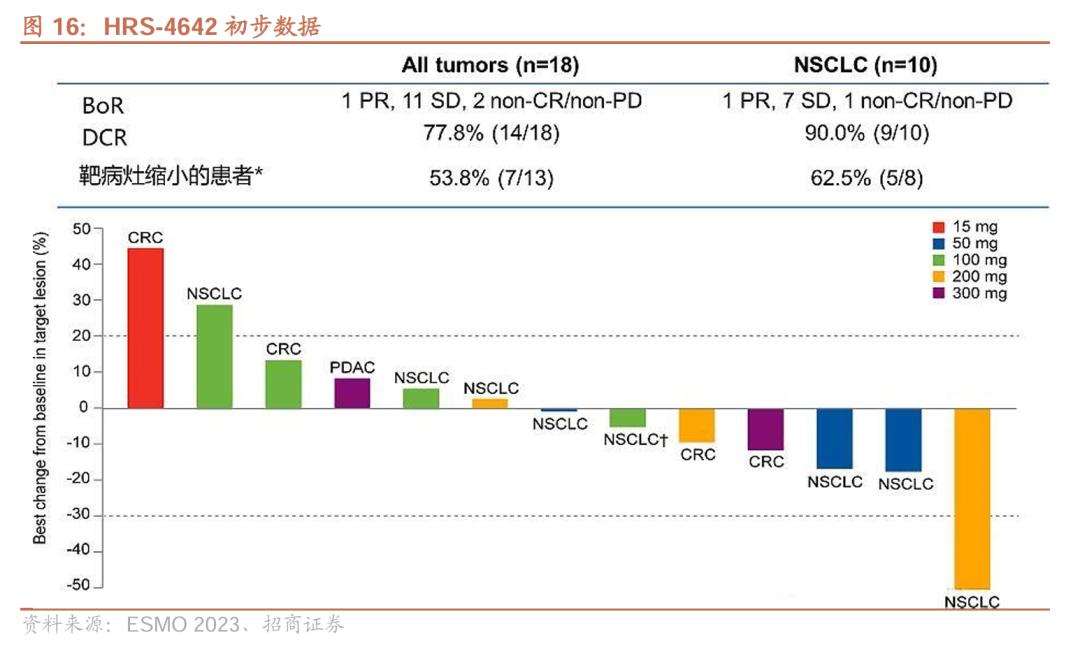

As early as 2023, HRS-4642 preliminary data was published by ESMO. The study included 18 patients (including 10 lung adenocarcinoma patients, 5 colorectal cancer patients, etc., median number of treatment lines was 3, Q2W). Among the 18 patients, 11 patients (61.1%) were in stable condition and 6 patients (33.3%) had target lesions reduced.

In the subgroup of 5 patients with colorectal cancer, 3 patients were in stable condition (SD) and 2 patients showed tumor regression.

In terms of safety, no dose-limiting toxicity (DLT) was observed in the study, the maximum tolerated dose (MTD) had not been reached, and 6 patients (33.3%) had TRAEs of grade 3 or higher, which were hypercholesterolemia (16.7%), lipase elevation (11.1%), and anemia (11.1%). No patients were discontinued from treatment or died due to TRAE.

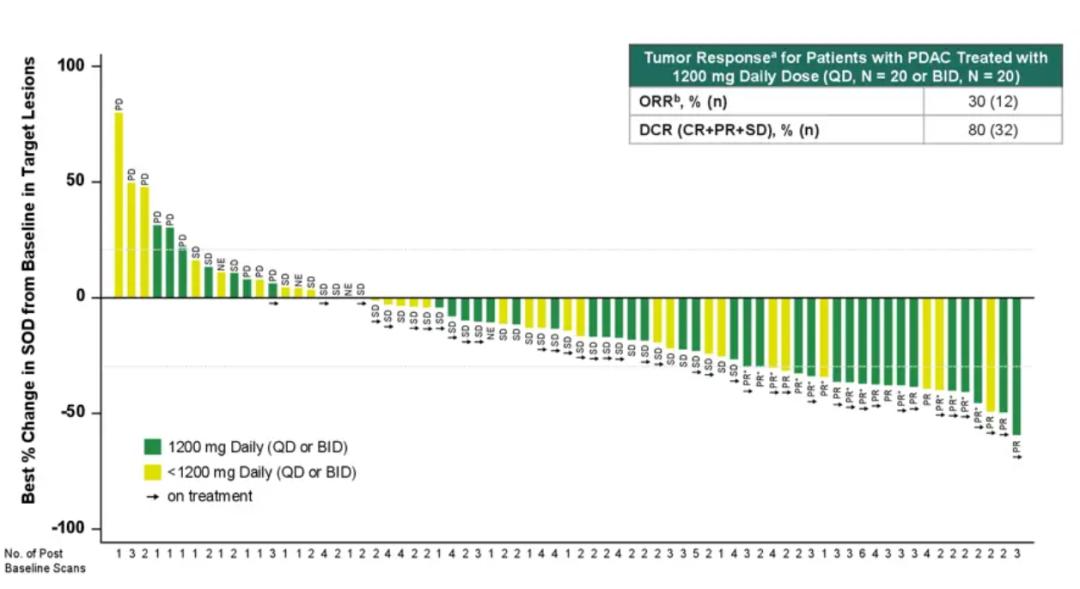

Revolution Medicines' KRAS G12D inhibitor Zoldonrasib has read out complete data from a global phase I cohort of pancreatic cancer and non-small cell lung cancer.

In October 2024, clinical data from the company's pancreatic ductal adenocarcinoma cohort (KRAS G12D mutation advanced patients with ≥1-line standard treatment failure) showed that among 46 evaluable pancreatic ductal adenocarcinoma patients treated with Zoldonrasib 1200mg QD or 600 mg BID, ORR was 30% and DCR was 80%.

The efficacy data provide a new treatment option for pancreatic ductal adenocarcinoma. It is important to note that the ORR of second-line chemotherapy was just over 20% and mOS was only 6-7 months, and the high ORR and DCR of Zoldonrasib indicate that it can effectively control disease progression.

In April 2025, the company announced non-small cell lung cancer cohort data showing an ORR of 61% (n=11) and DCR of 89% (n=16) in 18 evaluable NSCLC patients (all treated with the highest dose of 1200mg QD, with the same baseline as pancreatic cancer).

In a small sample of patients with KRAS G12D mutation, Zoldonrasib showed significantly better ORR performance than KRAS G12C inhibitors in second-line non-small cell lung cancer patients with KRAS G12C mutation.

In addition, the safety profile of Zoldonrasib was similar in both tumor cohorts, with treatment-related adverse events (TRAEs) mainly grade 1-2, with gastrointestinal reactions and rashes being the most common treatment-related adverse events, with a very small number of patients requiring dose reduction or discontinuation during treatment.

03、Opportunity for domestic molecules

After Hengrui, the fastest player in the KRAS G12D race is Jinfang Pharma, whose clinical data for pancreatic cancer and non-small cell lung cancer published at ASCO and WCLC this year have also surprised the market.

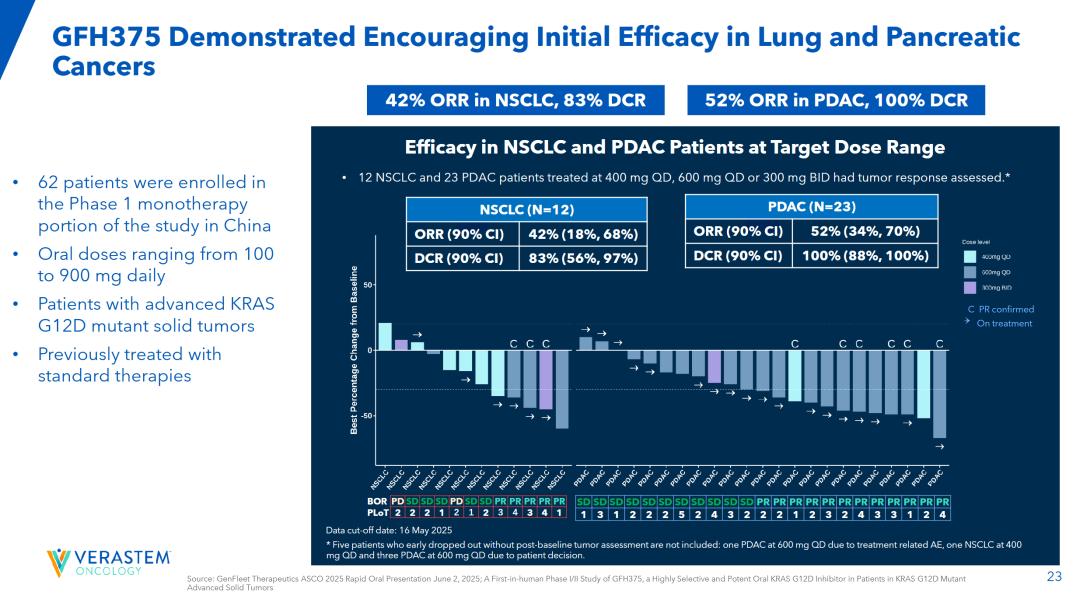

The latest GFH375/VS-7375 study data presented at the 2025 ASCO Congress (involving 75% of patients with advanced KRAS G12D-mutated solid tumors who had received two or more prior treatments) showed remarkable outcomes: Among 23 evaluable pancreatic ductal adenocarcinoma (PDAC) patients, the objective response rate (ORR) reached 52%, with a disease control rate (DCR) of 100%—indicating complete control or improvement in all treated pancreatic cancer cases. In a separate cohort of 12 non-small cell lung cancer patients, the ORR was 42% and DCR reached 83% (both groups received treatment with 400mg QD, 600mg QD, or 300mgBID regimens).

It is worth noting that GFH375/VS-7375 achieved such efficacy data (patients were more severe at baseline than the two previous drug trials) in the absence of effective treatment options for pancreatic ductal adenocarcinoma patients in the second and above lines, which clearly has BIC potential.

The 2025 World Lung Cancer Congress (WCLC) website has published updated data for the GFH375/VS-7375 subpopulation in non-small cell lung cancer (NSCLC) patients. At the recommended Phase 2 dose of 600 mg QD, the objective response rate (ORR) reached 68.8%, with a disease control rate (DCR) of 93.8%. Among 26 evaluable NSCLC patients treated across all dose levels, the ORR was 57.7% and DCR stood at 88.5%.

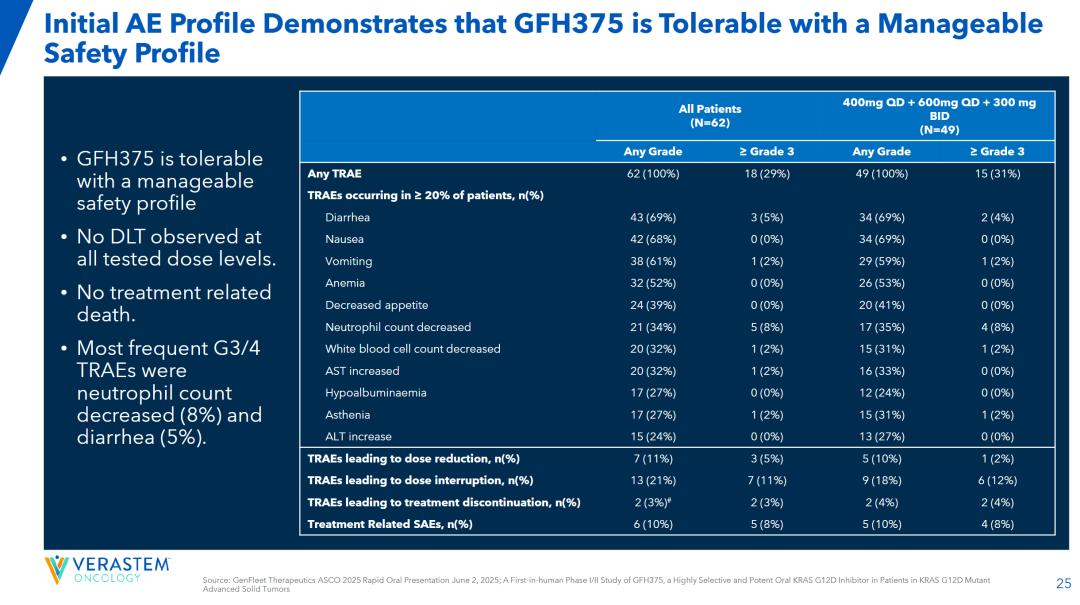

A comparison of ASCO and WCLC data shows that the efficacy of the drug is dose-dependent, which is very benign; in terms of safety, among all evaluated cancer types and dose levels, patients were mainly grade 1 or 2 TRAE, with the incidence of TRAE and SAE being 27.5% and 7.7%, respectively, for patients with grade 3 or higher.

Currently, the only KRAS G12D inhibitors approved for clinical use in China are Yousen Jianheng and Ailisi. Notably, Ailisi's selective KRAS G12D inhibitor AST2169, administered via liposomal injection, obtained clinical approval as early as March 2024. Subsequent data analysis is expected to pave the way for overseas market authorization.

In conclusion: While KRAS G12C inhibitors have achieved global commercialization and multiple blockbuster combination deals, the path toward pan-KRAS therapies—particularly pancreatic cancer, the "king of cancers" —remains challenging. Given that KRAS G12D mutations are prevalent among pancreatic cancer patients with early-stage data validation, substantial combination therapies or mergers and acquisitions will inevitably emerge. Stay tuned for developments!

Disclaimer: This article is only for the purpose of knowledge exchange and sharing, and does not involve commercial publicity, and does not serve as relevant medical guidance or medication advice. If there is any infringement, please contact us for deletion.

Our products are recommended:

1.139911-30-1 https://www.bicbiotech.com/product_detail.php?id=6399

2.851484-95-2 https://www.bicbiotech.com/product_detail.php?id=6400

3.1260847-45-7 https://www.bicbiotech.com/product_detail.php?id=6401

4.491833-36-4 https://www.bicbiotech.com/product_detail.php?id=6402

5.491833-29-5 https://www.bicbiotech.com/product_detail.php?id=6403