Faced with the potential tightening of U.S. pharmaceutical regulations, tariff barriers, or supply chain autonomy policies, multinational pharmaceutical companies (such as Pfizer, Roche, AstraZeneca, Merck & Co., etc.) may more actively seek high-potential, low-cost, and efficient R&D resources overseas. As the world's second-largest pharmaceutical market, China possesses a large number of high-quality preclinical and clinical-stage pipeline assets (especially in oncology, autoimmune diseases, and rare diseases), naturally becoming a focal point. International pharmaceutical companies are accelerating the acquisition of high-value research projects from Chinese biotech firms through licensing, joint development, equity investments, or even mergers and acquisitions to supplement their global R&D pipelines. The frequent cross-border deals between Chinese new drug assets and international pharmaceutical giants (Big Pharma) have prompted these industry leaders to intensify their efforts in securing China's premium clinical pipelines, resulting in a significant increase in overseas collaborations by Chinese biotech companies. Despite the surging wave of Chinese innovative drugs entering global markets, the continuous rise in cross-border deal values, and the expanding global influence, there remains a possibility that their value might be severely undervalued.

Simply put, the answer is complex: there may be an "undervalued" phenomenon in the short term and in individual trades; but in the long term and in the overall trend of the industry, it is more like a necessary process of value discovery and revaluation than a simple undervaluation.

Let's break this down on several levels:

Why is there a "possibility of undervaluation"? (Support the undervaluation view)

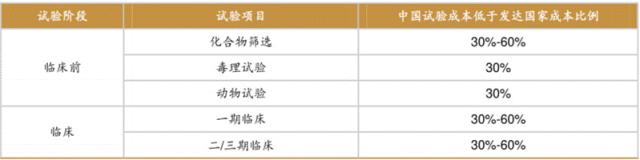

1. Huge R&D efficiency and cost advantages: China possesses a vast pool of scientific research talents, a mature CRO (Contract Research Organization) industry chain, and relatively low clinical development costs. According to my industry observations, the quotations from Chinese CRO companies are typically 30% -50% lower than those of international counterparts, while the salary of a senior medical doctor may be only one-third of that of their American counterparts. This cost advantage enables multinational pharmaceutical companies to advance more R&D projects with the same budget. This means Chinese pharmaceutical companies can develop high-quality drug candidates at faster speeds and lower costs. The "cost-effectiveness" that international pharmaceutical giants value is precisely this advantage—their investment in time and efficiency may not fully reflect the overall efficiency advantage of Chinese teams.

Table 1 The cost of CRO service in China is relatively low.

Source: FROST&SULLIVAN, compiled by Southwest Securities

2. The Discount of "China Data": ① Historical Experience and Trust Issues: In the past, multinational pharmaceutical companies were skeptical about China's clinical data, believing that the trial designs of China's innovative drug companies were not rigorous enough. Early-stage clinical trials predominantly adopted single-arm studies, lacked head-to-head controls, and had small sample sizes. Moreover, multinational pharmaceutical companies had encountered numerous pitfalls in License deals in the past, making it natural for them to be cautious about data from unfamiliar regions. ② Data Quality and Validation Requirements: Multinational pharmaceutical companies are highly sensitive to data quality during due diligence. Poor data quality or artificial embellishments could undermine the foundation of their judgments. Therefore, they tend to require validation in familiar regions like Europe and America to ensure the reliability and validity of the data.

③ Valuation Discount and Risk Control: Due to the uncertainty of "China data", multinational pharmaceutical companies increase discounts during valuation to mitigate risks. This "Chinese-style valuation discount" objectively exists, particularly during the early data phase. Although Chinese pharmaceutical companies have advantages in R&D efficiency and cost, international pharmaceutical companies still need to verify the reliability of their data.④ Market and Policy Environment Changes: With China's pharmaceutical regulatory reforms and the establishment of international data mutual recognition mechanisms, China's clinical trials are gradually adopting international standards, enhancing the credibility of China data. However, multinational pharmaceutical companies still require time to build trust, especially during the early data phase.⑤ Cost and Efficiency Considerations: Although China has advantages in R&D costs and efficiency, multinational pharmaceutical companies still need to conduct verification in Europe and the United States to ensure data reliability, which may increase costs and time.

3. Urgent Cash Flow Pressure and Weak Bargaining Power: Many Biotech companies face immense financing pressures and cash flow bottlenecks, with "survival" being the top priority. A Biotech founder once told me in private discussions: 'The choices we faced in 2023 were brutal—— either accept a relatively low valuation to immediately secure life-saving funds or take a gamble that we might not survive until the next milestone. Ultimately, we chose the former. This placed them in a relatively weak position during negotiations. To expedite transaction completion and obtain upfront payments, they might compromise on the total deal value and accept an' underestimated 'offer. Cash flow is the lifeline of corporate survival, especially for innovative pharmaceutical companies, where dual pressures from R&D investment and commercialization operations make them highly sensitive to liquidity. By licensing China rights to multinational giants like Pfizer and AstraZeneca, companies can secure substantial upfront payments and potential milestone payments, directly alleviating short-term cash flow pressures. For instance, CStone Pharmaceuticals licensed the China rights for its oncology drugs Puri® (plalutinib) and TopShuwo® (evonib) to Pfizer and Servier. Although the specific upfront payment amount was undisclosed, similar transactions like Aili's licensing of Fosunib's equity in China to AstraZeneca often see upfront payments constituting a significant portion of the total deal value, serving as the most direct short-term cash source. This "cash flow back" effectively covers R&D investments, employee compensation, and operational costs, preventing operational crises caused by broken capital chains.

4. Weakness in overseas market operations: The vast majority of China Biotech companies lack capabilities in overseas clinical trials, registration, and commercialization. The realization of a drug's overseas value is entirely dependent on partners. This insufficient "non-optional" scarcity also weakens their bargaining power.

II. Why "not simply undervalued"? (Against the view of being undervalued)

1. Reasonable consideration for risk allocation: The essence of BD transactions lies in shared risks and benefits, akin to a high-risk game: China Biotech provides carefully cultivated 'seeds' (early-stage pipelines), while multinational pharmaceutical companies invest heavily in 'fertilizing, watering, and harvesting' (subsequent development and commercialization). The upfront payment merely represents the price for purchasing this 'game ticket'. Chinese pharmaceutical companies have almost entirely transferred the risks of drug development, registration, and commercialization in overseas markets (particularly Europe and America) to their partners. Partners will invest hundreds of millions or even billions of dollars to bear all subsequent high-risk and high-cost responsibilities. Their upfront payments and milestone payments serve as prepayments and consideration for such risk-taking, rather than merely covering current drug data. The total transaction value (TDC) is substantial, but the final amount received depends on the partner's success.

2. Phased Realization of Value: The value of a drug grows exponentially as the R&D phase progresses. A molecule in Phase I clinical trials and one that has been approved for market approval differ vastly in value. Most of China's current License-out transactions are concentrated in early clinical stages (Phase I and II). At this stage, the probability of drug failure remains high. International pharmaceutical companies pay hundreds of millions of dollars in upfront payments for early-stage assets, which essentially grants a significant risk premium—a recognition of their potential value rather than an underestimation.

3. Distinction Between Platform Technology and Products: In recent years, some transactions (such as the Novartis-Belgenzyme deal for TIGIT inhibitors) have drawn criticism for being "undervalued" despite their massive total value, primarily due to relatively low upfront payments. This often reflects a cautious approach toward evaluating entire technology platforms and the uncertainty surrounding individual product data. Major pharmaceutical companies are essentially paying for "options" rather than immediately acquiring a guaranteed success.

4. Market-driven fair outcome: BD transactions are the result of negotiations between buyers and sellers in public markets or private bidding. Although individual companies may compromise due to cash flow pressures, the overall trend of frequent transactions and steadily increasing transaction values (such as the multiple deals between Kelunbo Tai and Merck & Co., with cumulative total amounts nearing $11.8 billion) precisely demonstrates a maturing Chinese innovative drug market whose value is being increasingly recognized. If there were truly systemic undervaluation, no major pharmaceutical companies would be rushing to enter the market to "snag" deals.

III. How to view this phenomenon? —— The inevitable path of value revaluation

It is one-sided to simply define the wave of China's new drug BD as "undervalued assets". A more accurate description would be: China's innovative drugs are undergoing a vigorous process of "value discovery" and "value revaluation".

1. The Shift from "Me-too" to "FIC/BIC": Early-stage transactions were predominantly follow-the-leader innovations (Me-too), which naturally limited pricing power. Today, the portfolio increasingly includes truly first-in-class (first-to-market) or best-in-class (best-in-class) assets (e.g., Legend Biotech's CAR-T, Hutchmed Pharma's Fruquintinib, and Biotec Group's BL-B01D1). These assets demonstrate significantly enhanced pricing power and transaction value, marking a reevaluation of their market worth.

2. The "Credit Accumulation" of International Recognition: Every successful BD transaction and each time a new Chinese drug is approved for overseas market launch (such as Zanubrutinib and Fruquintinib) enhances the brand value of "China Innovation". As more success stories emerge, international pharmaceutical companies will increase their trust in China's data, reduce valuation discounts, and achieve more comprehensive value discovery.

3. The Enhancement of Bargaining Power of Chinese Pharmaceutical Companies: With the strengthening of their financial capabilities, accumulation of overseas clinical experience, and deepening understanding of global regulations, Chinese pharmaceutical companies are steadily enhancing their bargaining power. They have gained better insights into designing global clinical trials and negotiating with industry giants to secure more favorable terms.

conclusion

There is no systematic or long-term undervaluation of China's new drug assets in the BD transactions. The current transaction landscape truly reflects the stage of industrial development: For assets with genuine global innovation capabilities and differentiated advantages, their value is being and continues to be discovered, as evidenced by the repeatedly record-breaking transaction values. For assets with insufficient innovation potential or higher risks, their transaction terms are relatively stringent, reflecting the harsh risk pricing logic in the global pharmaceutical market rather than being "undervalued".

The author believes that frequent BD transactions bring far greater benefits than drawbacks to China's pharmaceutical industry. It signifies that China's innovation is being integrated into the global R&D system, becoming an indispensable component. This provides enterprises with valuable cash flow and a springboard for internationalization, ultimately enabling Chinese patients to access the world's latest medications more quickly and propelling China from a "pharmaceutical giant" to a "pharmaceutical powerhouse". Therefore, the crux of the issue lies not in whether it is "undervalued", but in how to sustainably generate more high-value assets that are not undervalued.

Disclaimer: This article is only for the purpose of knowledge exchange and sharing, and does not involve commercial publicity, and does not serve as relevant medical guidance or medication advice. If there is any infringement of this article, please contact us for deletion.

Our products are recommended:

1.81115-59-5 https://www.bicbiotech.com/product_detail.php?id=6409

2.95645-00-4 https://www.bicbiotech.com/product_detail.php?id=6410

3.2382997-02-4 https://www.bicbiotech.com/product_detail.php?id=6411

4.1211538-09-8 https://www.bicbiotech.com/product_detail.php?id=6412

5.1354355-85-3 https://www.bicbiotech.com/product_detail.php?id=6413