In 2023, new peptide and peptidomimetic drugs ushered in the spring. FDA's CDER approved 55 new molecular entities (NME) drugs, including six peptidomimetic NME drugs, accounting for 11% of the new molecular entities approved by CDER this year.

What will be the change of polypeptide drugs in 2024?

It is understood that the PDUFA calendar for 2024 has not been fully released, and according to the current known information, there are two peptide drugs that will be reviewed by the FDA in 2024.

In terms of market size, the polypeptide drug market is expected to grow at a compound annual growth rate of around 7.5% from 2023 to 2032, and reach a size of $82.6 billion by 2032.

01,2 peptides that are about to hit the line

- GA Depot

- Manufacturer: Viatris Inc./Mapi Pharma Ltd.

- Indication: Recurrent multiple sclerosis (RMS, Relapsing Multiple Sclerosis)

- PDUFA date: March 8,2024

Gratre acetate, sold under trade names such as Copaxone®, is an immunomodulatory drug used to treat multiple sclerosis. It received FDA approval in 1996 and launched generic drugs in 2017. It is approved in the United States to reduce the frequency of MS relapse, but can not be used to reduce the progression of disability, when administered by subcutaneous injection.

Viatris Inc. And Mapi Pharma Ltd. The NDA application for long-acting Gratre acetate assets (GA Depot 40 mg) has been accepted by the FDA and will be subject to regulatory review on March 8,2024.

GA Depot Is an approved long-acting injection version of Glatiramer Acetate (GA, trade Copaxone®), administered intramuscular once every four weeks for the treatment of recurrent multiple sclerosis (RMS, Relapsing Multiple Sclerosis). GA Depot The Phase II testing of primary progressive multiple sclerosis (PPMS, Primary Progressive Multiple Sclerosis) is also currently underway.

Once approved, GA Depot can improve the patient experience by reducing the number of injections, improving tolerance and improving compliance (Sandoz Glatopa since 2015 is a generic version of the GA 20 mg formula requiring daily injections).

- Palopegteriparatide

- Manufacturer: Ascendis Pharma A / S

- Indication: Chronic hypoparathyroidism in the adult population

- PDUFA Date: May 14,2024

Palopegteriparatide Is a PEGylated parathyroid hormone that is the prodrug of parathyroid hormone (PTH [1-34]), administered once a day. Human parathyroid hormone (PTH) synthesized peptide fragments (1-34) [PTH (1-34)] conjugated with O-methyl polyethylene glycol (2 x 20 kDa mPEG) by Tarnscon Linker at the N-terminal amino group through the cleavable connector.

Hypoparathyroidism is an endocrine disease caused by insufficient levels of PTH (parathyroid hormone). PTH is the main regulator of calcium / phosphorus balance in the body, acting directly on the bones and kidneys, and indirectly on the intestine. Patients with hypoparathyroidism may experience a range of severe and potentially life-threatening short-and long-term complications, including neuromuscular hypersensitivity, renal complications, extraskeletal calcification, and cognitive impairment. Postoperative hypoparathyroidism accounts for the majority of cases (78%), with other etiologies including autoimmune disease, familial disease, and idiopathic causes.

The FDA in May 2023 rejected a new drug application for palopegteriparatide for adults with hypoparathyroidism due of concerns about production control strategies.

The FDA issued a full response for the palopegteriparatide due to concerns about a manufacturing control strategy for delivery dose variability in this drug / device combination product. The FDA does not have any concerns about the clinical data presented in the application or requests for new preclinical studies or phase 3 clinical trials.

Palopegteriparatide Was subsequently approved by the European Commission in November 2023 under the trade name Yorvipath. Ascendis Resubmitted the palopegteriparatide NDA application and received acceptance by the FDA in late 2023, PDUFA dated May 14,2024.

02, $82.6 billion, polypeptide drug market analysis

According to relevant data, the market size of peptide therapy is about $39.3 billion in 2022, and is expected to grow at a compound annual growth rate of about 7.5% from 2023 to 2032, and reach $82.6 billion in 2032.

The rising prevalence of chronic diseases such as diabetes, obesity and cancer provides an opportunity to expand the market for polypeptide drugs.

According to the 2022 US National Diabetes Statistics report, diabetes affects 37.3 million people, representing 11.3% of the US population, and 90 – 95% have type 2 diabetes. Beyond diabetes, obesity became the biggest stimulus for increased polypeptide drugs. Goldman Sachs estimates that by 2030,15 million obese American adults will use diet drugs. Novo Nordisk's Wegovy (semaglutide) and Lilly's Zepbound (tirzepatide) have become two mainstay in the field of obesity. Morgan Stanley It expects Zepbound to reap $2.2 billion in sales in 2024. Bank of America is more optimistic, which expects Zepbound to achieve $2.7 billion in 2024.

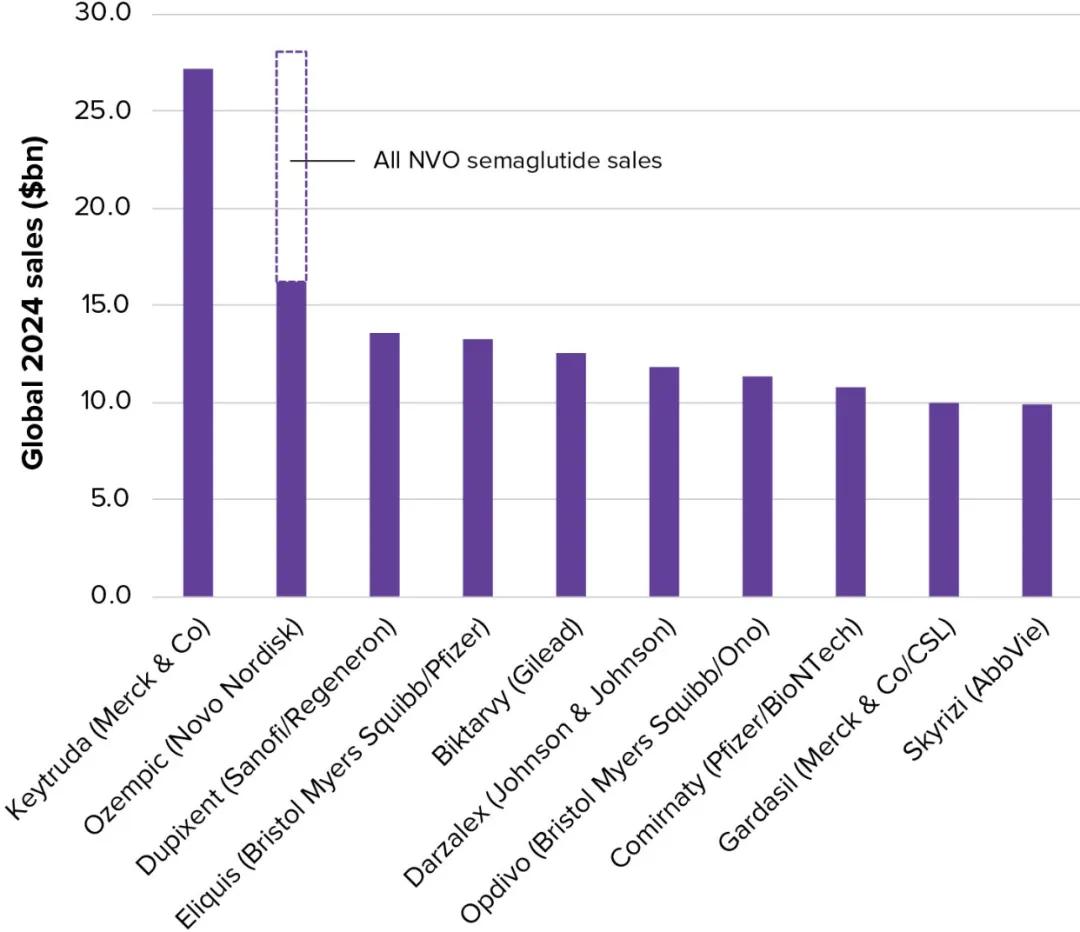

In contrast, Nordno's GLP-1 assets, with semaglutide as the active drug Ozempic, Wegovy and Rybelsus "combined category", are estimated to exceed $28 billion in 2024, thus surpassing Keytruda to become the global pharmaceutical king (Figure 1).

It is widely believed that the GLP-1 peptide diet pills will have an $80- $100 billion market in 2030.

Figure 1 Top 10 drugs in expected global sales in 2024 Photo Source: Evaluate

Covid-19 has had an impact on the growth of the global peptide therapy market. Pfizer's Paxlovid, which plays an important role in the fight against the epidemic, and nirmatrelvir, its active ingredient, is a peptidomimetic product. In addition, many polypeptide-based Covid-19 vaccines are in clinical trials. About 21 peptide drugs are under development, 15 of the related respiratory problems caused by acute respiratory distress syndrome (ARDS) and SARS-CO-2 infections are synthetic peptide drugs. Because of its easy synthesis, high target specificity, selectivity, and low toxicity, researchers have been working to develop peptide therapies for various diseases, including cancer. Due to the advantages of polypeptide therapy over chemotherapy and radiation therapy, it has a high potential in anti-tumor drug development. In addition, R & D investments include the development of new peptide drug delivery systems.

Based on type, polypeptide drugs are branded and generic drugs, which account for more than half of the market, with a projected compound annual growth rate of 7.7% from 2023 to 2032. The market for generic polypeptide drugs is expected to see substantial growth, reaching $27.1 billion by 2032.

From the perspective of application, peptide therapy mainly aims at metabolic diseases, cancer, cardiovascular disease, gastrointestinal tract, central nervous system, infectious diseases, respiratory diseases, pain management, kidney disease, dermatology, etc. Due to the high prevalence of metabolic diseases such as diabetes, the largest metabolic disease segment market share was 35.4% in 2022.

From the perspective of administration route, peptide therapy can be divided into parenteral, oral, and other routes of administration. In 2022, the parenteral drug market size reached us $31.6 billion and is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2032.

Ref.1.Viatris and Mapi Pharma Announce FDA Acceptance of New Drug Application Filing for GA Depot for the Treatment of Relapsing Forms of Multiple Sclerosis.PR Newswire.07.08.2023.2.Ascendis Pharma Receives Positive CHMP Opinion for TransCon™PTH(palopegteriparatide)for Adults with Chronic Hypoparathyroidism.Ascendis Pharma Press Release.14.09.2023.3.Constantino,A.K.The weight loss drug boom isn’t over yet—here’s what to expect in the year ahead.CNBC.17.12.2023.4.Peptide Therapeutics Market-By Type(Branded,Generic),Application(Metabolic,Cancer,Cardiovascular,Gastrointestinal),Route of Administration(Parenteral,Oral),Distribution Channel(Hospital,Retail)-Global Forecast 2023-2032.Global Market Insights.May.2023.