While the competition between Semaglutide and tirzepatide in THE field of obesity is in full swing, the competition between young people is already on the way, and the competition against BIC (Best-in-class, best in its class) has begun.

01,12 weight loss of 13.1% weeks, BIC potential is huge

The first candidate claiming to be a BIC is amycretin, Novo Nordisk's daily oral formulation, whose CEO Lars Fruergaard Jørgensen recently said that amycretin could be a BIC for the treatment of obesity.

Amycretin Is a co-agonist of GLP-1 and amylin (Figure 1), which is currently in phase I, and has achieved a weight loss of 13.1% in 12 weeks, far exceeding the performance of 6% in the same period of Wegovy.

Figure 1 Amycretin Mechanism of weight loss Photo source: Novo Nordisk

The molecular structure of amycretin is currently unknown, but from its technical characterization of using the osmotic enhancer SNAC, its molecule should be a polypeptide mode. Novo Nordisk said amycretin will enter phase II research in the second half of this year, expects results in early 2026, and expects to bring it to market by 2030.

At about the same time with Novo Nordisk releasing the phase amycretin I results, Viking Therapeutics also announced the clinical results of the phase I weight loss candidate asset, VK2735 oral formulation. VK2735 In a very small trial, patients who received the highest dose level lost 5.3% of their weight after 28 days, and as many as 57% of patients lost at least 5%. After 13 weeks of treatment, VK2735 has induced an average weight loss of 13.1%, which has surpassed the concurrent performance of tirzepatide, a GLP-1 / GIP dual-receptor co-agonist. Leerink Partners Analysts said in their research report that the results support VK2735's potential for BIC.

Both Amycretin and VK2735 have become a potential BIC, but this is not logically contradictory, with the potential of being a BIC before the official crown of a BIC.

But the BIC here may not be conceptual in a narrow sense. In the narrow sense, the "similar" designation in BIC usually needs to target the same target, and Amycretin is GLP-1 and amylin dual receptor coagonist, VK2357 is GLP-1 and GIP dual receptor agonist, so strictly speaking, these two drugs are not the standard "similar", Amycretin is its own class, while VK2357 and tirzepatide belong to the "similar".

BIC drugs are subsequent drugs that are considered superior to first drugs within the established mechanism of action (FIC, first-in-class) and similar drugs (next-in-class). Compared to them, BIC provides better efficacy, safety, patient compliance, or reduced treatment costs. These advantages could make BIC drugs the therapy of choice in their therapeutic field.

02. Business competition between FIC and BIC

FIC is the goal pursued by pharmaceutical companies, but if it loses the race after FIC, it can still be reversed by being a BIC.

One study found that 68 percent of the top 10 pharmaceutical giants competed for at least five assets. For example, at least 50 assets involving PD (L) 1 are being developed, so the competition for BIC is very fierce.

Who is more commercially successful, either FIC or BIC? This can not be generalized.

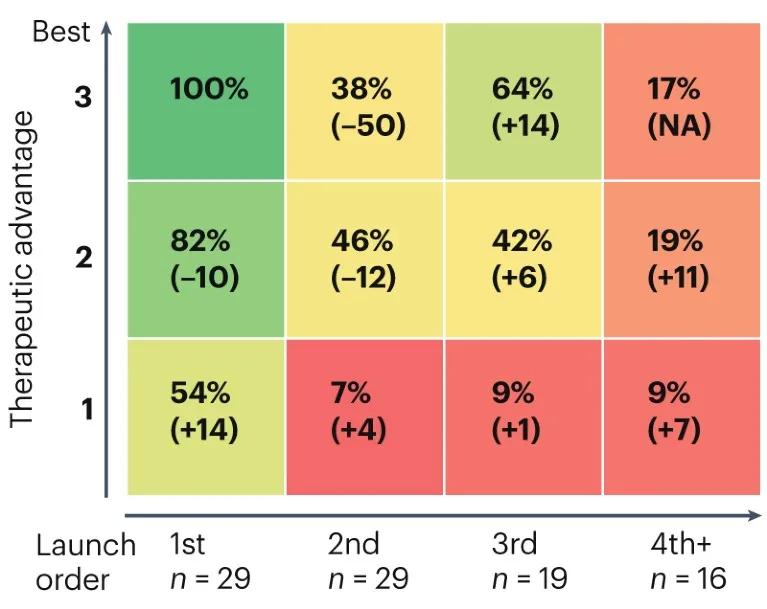

In a specific study, the investigators evaluated 29 classes of drugs with new mechanisms introduced after 2010, including a total of 104 products. The commercial performance of FIC and BIC was analyzed by marketing order, treatment advantage (efficacy, safety and delivery, 1 worst, 3 best) and commercial success (forecast global sales by 2028).

Figure 2 Marketing sequence and efficacy Related to Sales Sales are normalized with FIC / BIC drugs (top left, 100%) Photo Source: Nature Reviews Drug Discovery

The analysis results show that the first launched products with new mechanisms tend to perform better. The sales of the second batch of listed BIC were only 38% of those products that are both FIC and BIC. In contrast, the moderately effective FIC sold 82% of those with both FIC and BIC products, but more than double the second batch of marketed BIC drugs. Even those FIC with the worst relative efficacy received 54% of the sales of both FIC and BIC products.This result seems to illustrate the association between FIC and commercial success.

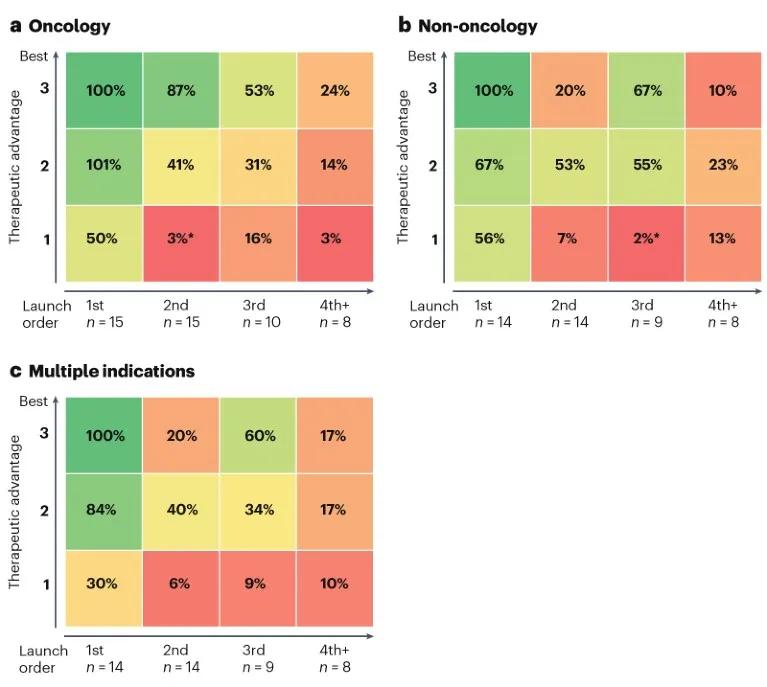

Figure 3 Market segmentation of the relationship between product sales and efficacy / marketing sequence (a) oncology products, (b) non-oncology products, (c) products with multiple indications Photo source: Nature Reviews Drug Discovery

Subdividing from the perspective of indication, oncology products seem to favor FIC. The study found (Figure 3a) that FIC oncology products can have significant advantages over next-in-class products as long as they have moderate efficacy.

In contrast, markets outside of oncology are more friendly to newcomers (Figure 3b), especially in areas where patients may have "horizontal bar" indications, such as migraine, psoriasis and other inflammatory diseases. In these areas, the possibility of significant product differentiation is relatively small, and the first product entering the market is unlikely to be absolutely dominant. For products with this feature, developers need to consider other potential differentiation factors besides efficacy and time-to-market, including promotional strategies or ways to gain competitive access.

The advantages of FIC / BIC are evident in drug classes that cover multiple indications, in part because they expand the range of indications more quickly (Figure 3c). BIC but the second listed product sells only 20% of FIC / BIC.

03 Strategies of the latecomers

The comers have lost their time to market, but they could still achieve significant commercial success.

Follow in the footsteps of FIC as soon as possible to launch BIC, or increase the efficacy advantage of BIC. Most BIC listed within two years of the launch of FIC can achieve at least comparable commercial performance to FIC. If BIC have more obvious advantages, they are expected to surpass FIC's sales.

Develop more valuable indications to expand the potential market. For example, the third marketed SGLT 2 inhibitor, empagliflozin, reduces the risk of heart failure even in patients without type 2 diabetes.

Use of new modal drugs with better performance: for example, CAR-T therapy brexucabtagene autoleucel can replace the bispecific antibody blinatumomab for treating acute lymphoblastic leukemia.

Market latecomers can also promote competition through innovative market access strategies, or through more convenient drug delivery methods.

Back to the diet drug potential BIC of Novo Nordisk and Viking, they have shown weight loss rates beyond the clinical data over their predecessors tirzepatide and semaglutide. More importantly, both of the weight-loss drug candidates are administered by oral delivery. While these drugs are still time before they hit the market, these potential BIC could have a significant impact on the huge obesity market (which some analysts predict is worth $80 billion to $100 billion a year).

Ref.

1. Constantino,A.K.Novo Nordisk CEO says experimental weight loss pill could become a best-in-class drug.CNBC.08.03.2024.

2.athan-Kazis,J.Viking Therapeutics Posts Promising Early Weight-Loss Data as Cost Worries Escalate.Barron’s.26.03.2024.

3.Vinluan,F.Viking Therapeutics Obesity Drug’s Data Raise Best-in-Class Expectations.Medcity News.27.02.2024.

4.What Makes a Drug Best-in-Class?Drug Hunter.18.08.2022.

5.Spring,L.et al.First-in-class versus best-in-class:an update for new market dynamics.Nature Reviews Drug Discovery 22,531-532(2023)

6.Gronholt-Pedersen,J.et al.Novo valuation surpasses Tesla on experimental obesity drug data.Reuters.07.03.2024.