With the rise of large molecule drugs, the idea that small molecule drugs slowly fading.

In the latest list of category 1 new drugs selling more than 1 billion yuan in China in 2023 released by drug hunters, the number of large molecules and small molecule drugs is the same, and the approved sales of more than 1 billion drugs after 2020, small molecule drugs are still one more than large molecules.

Because Protac (protein degradation), the small molecule highlight is approaching, the MNC manufacturers show too much content.

On April 11,2024, Novartis reached a partnership with Arvinas to introduce the global interest in two Arvinas targeted protein degraders (ARV-766, AR-V7) at a total transaction price of $1.16 billion ($150 million down payment + $1.01 billion milestone payment and additional sales share).

In the same month, Nurix expanded and extended the partnership between Sanofi and Gilead, and planned an additional offering, resulting in a large extension fee and proceeds to advance the further development of the pipeline.

In March 2024, C4 Therapeutics and Merck agreed to jointly develop two targeted protein degraders for key oncogenic proteins, with C4 receiving a $16 million down payment + a potential milestone of up to $740 million and an additional sales share.

The intensive cooperation between big factories and Protac Biotech may make some keen investors sense an opportunity, and the commercialization era of Protac may accelerate.

01, pioneer Arvinas, is also the most likely to be acquired

Financial services firm Cantor Fitzgerald expects 2024 to be a year of strong growth in M & A activity in the oncology drug industry, with protein degradation pioneer Arvinas among the most likely potential targets.

This is not surprising. Arvinas, as the fastest pipeline and the largest protein degradation player in the world, has attracted the attention of MNC and institutional investors.

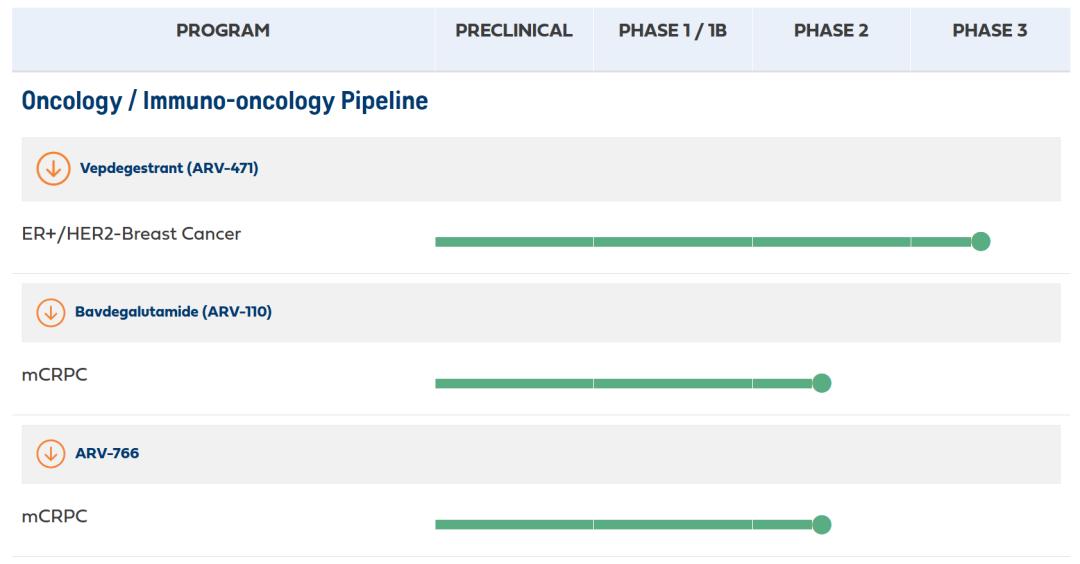

At present, there are two Arvinas cores in development, namely ARV-766, which is about to start phase III clinic, and ARV-471, which is in phase III clinic; the former has just reached a global equity partnership with Novartis, while the latter has granted the interest to Pfizer earlier.

To gain the favor of the two top MNC, Arvinas efficacy and indications must be strong, and it does have the potential to do both.

The first is the indication, only take small molecule drugs as an example, pabosone (HER 2), and amine (AR) drug peak sales of more than 10 billion dollars, and ARV-766, ARV-471 core indications respectively resistant prostate cancer (CRPC) and advanced breast cancer, can be regarded as the two blockbuster "new generation of succession drugs"; more interestingly, paboxone and two drugs are under Pfizer, which also makes "Pfizer will buy Arvinas" rumors.

Second, ARV-766 and ARV-471 also demonstrated potential in preliminary clinical data.

At the 2023 ESMO conference, Arvinas Phase 1 / 2 interim data showed that ARV-766 degradable wild-type and all clinically relevant AR ligand binding domain (LBD) mutations achieved PSA50 in 41% of patients with any LBD mutant mCRPC (with PSA levels reduced by at least 50%) and 50% of patients with AR L702H mutant tumor mCRPC achieved PSA50.

It is well known that AR variants cause progression to a lethal castration resistance stage in prostate cancer patients, and ARV-766 has shown a broad spectrum of pan-AR degraders in early data, which is expected to fill the clinical gap in mCRPC therapy in the future.

The latest Phase II data published by ARV-471 for patients with advanced or metastatic ER + / HER 2-breast cancer (4) in 2022 showed that the CBR for all patients was 38% (24 weeks of complete, partial CBR or stable disease) and the CBR for ESR 1 and ESR 1 was 20% and ES1.2%; in addition, the low and high-dose CBR were 37.1% and 39%, respectively.

It is worth noting that ER + / HER 2-breast cancer patients account for about 70% of the total number of breast cancer patients, but such patients often lack effective targeted treatment. Even though ARV-471 has limited response rate for ESR 1 wild-type patients, there are still high hopes by the market.

More importantly, ARV-471 is about to close the commercial barrier. The first Phase III trial of ARV-471 was launched in December 2022 to verify its efficacy in head-to-head treatment in patients with advanced recurrent breast cancer. The trial is expected to be completed by 2024; that is, the first successful validation result in the Protac field is available this year.

02, overseas players more than one blossom

In addition to the pioneer Arvinas rush, the Biotech with several major clinical Protac assets also has a lot of progress.

At least from the perspective of stock price, since October 2023, Kymera, Nurix and C4 have gained 156.9%, 114.07% and 305.98% respectively.

(Summary of the recent stock price movements of the big three Protac Biotech players)

While expectations of a Fed rate cut have helped these Biotech shares, a lot of the gains lie in the progress of the players themselves.

In November 2023, the Kymera core line IRAK 4 degrader KT-474 published an early clinical data (n=105): degradation of IRAK 4 was observed in the blood of healthy volunteers with 93% reduction of IRAK 4 at a single dose of 600-1600mg; and daily administration at 50-200mg of IRAK 4 after 14 days.

As the inhibition of IRAK 4 alleviates rheumatoid arthritis, systemic lupus erythematosus, multiple sclerosis, atopic dermatitis and other diseases, it undoubtedly announces the great potential of KT-474 in the field of self-exemption.

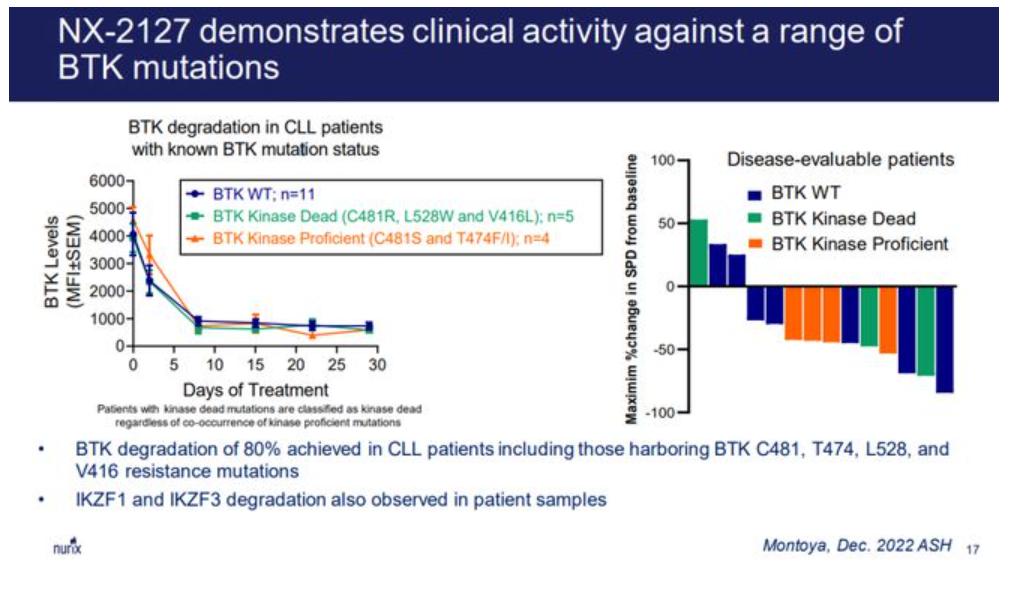

Nurix The summary of phase I clinical data of NX-2127 published at ASH 2023 showed that NX-2127 can achieve rapid and continuous BTK degradation and biorelevant degradation of Ikaros regardless of absolute BTK initiation level, tumor type or dose.

The trial targeted patients after the average 4 lines, such as slow shower (CLL) patients who had been treated with BTK inhibitors, 76% of patients had been treated with BCL 2 inhibitors, and a large number of patients had BTK resistance mutations at baseline. This means that NX-2127 may in the future be a therapeutic option after resistance to first-and second-line small-molecule inhibitors of multiple hemangioma.

The positive clinical results of more and more Protac molecules will undoubtedly add more support and light to the market prospect of Protac becoming a best-selling or even mainstream therapeutic drug in the future.

03, Domestic Protac molecules

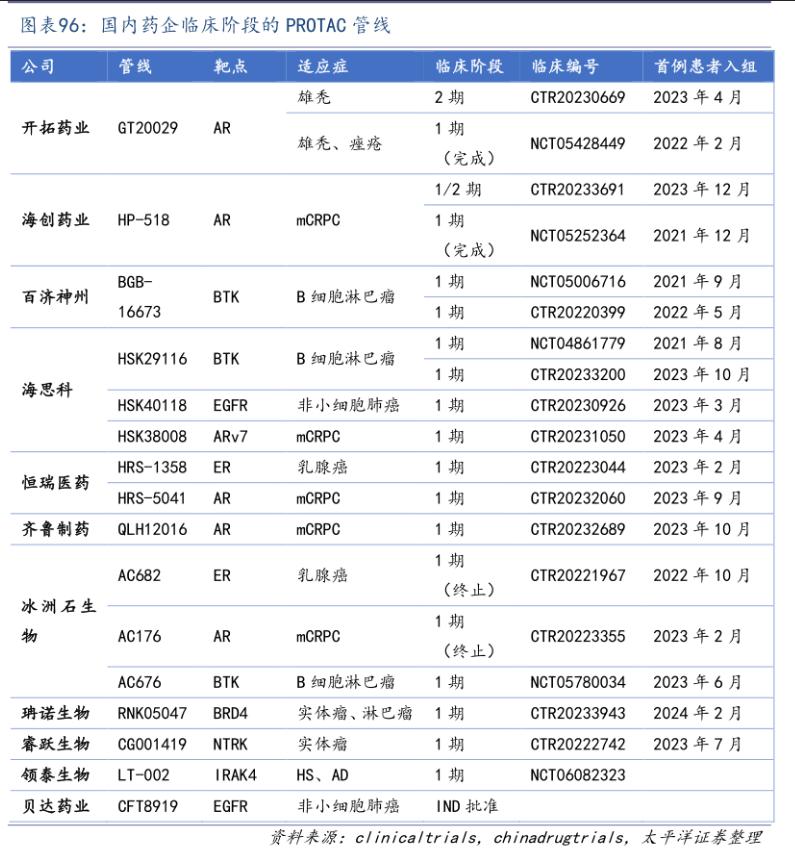

In the field of Protac, the research and development progress of domestic molecules has not been abandoned by overseas pioneers. At present, the multiple domestic clinical assets have entered the early clinical end and moved forward to the middle and late clinical stage.

Among the domestic Protac molecules, the most attractive investor is undoubtedly the BTK degrader BGB-16673. According to the preliminary data of BGB-16673 released by Paiigene in 2023 ASH conference, the ORR of 26 patients with relapsed and refractory B cell malignancy (previously receiving multiline therapy) reached 67%, and the patients had good tolerance and no adverse reactions such as atrial fibrillation and hypertension. Paiigene plans to quickly enter the second phase of the clinic in the near future.

Secondly, the fastest progressing pipeline in China is the external AR degrader GT20029 of pioneering Pharmaceutical. The results of the first phase of the pipeline show a good safety tolerance in healthy subjects, male failure patients and patients with acne. At the same time, in the third quarter of 2023, GT20029 has completed the enrollment of all the secondary clinical patients in China.

It is worth noting that the current domestic has the most Protac pipeline, and the formation of technology platform innovation drug companies is sea, not only has the first BTK degradation into clinical HSK29116, at the same time in the clinical pipeline and EGFR HSK40118, ARV 7 HSK38008 (the target is one of the targets for novartis and Arvinas cooperation, sea HSK38008 into clinical earlier).

In addition to the above domestic leading enterprises and pipelines, such as Hengrui Pharmaceutical, Haichuang Pharmaceutical, Bei Boda Pharmaceutical and a number of unlisted Biotech have also acquired pipeline assets in the clinical stage through self-research or introduction. It is believed that License-out BD transaction will soon be born in the Protac field.

epilogue:

If Protac drugs can provide a significant therapeutic window for patients in "terminal diseases" such as low HER 2-expression and castration-resistant prostate cancer, it is only a matter of time before the potential to become a new type of drug field than ADC.