"To test the body" weight loss Bo Rui pharmaceutical chairman, and make the market attention of the "big action".

Bo red pharmaceutical announced on May 7, the company to a specific object, chairman Yuan Jiandong will fully subscribe all the shares, the amount does not exceed 500 million yuan, subscription average of 22.56 yuan / share (the latest closing price discount of about 36.45%), all proposed to supplement liquidity and repay the bank loans.

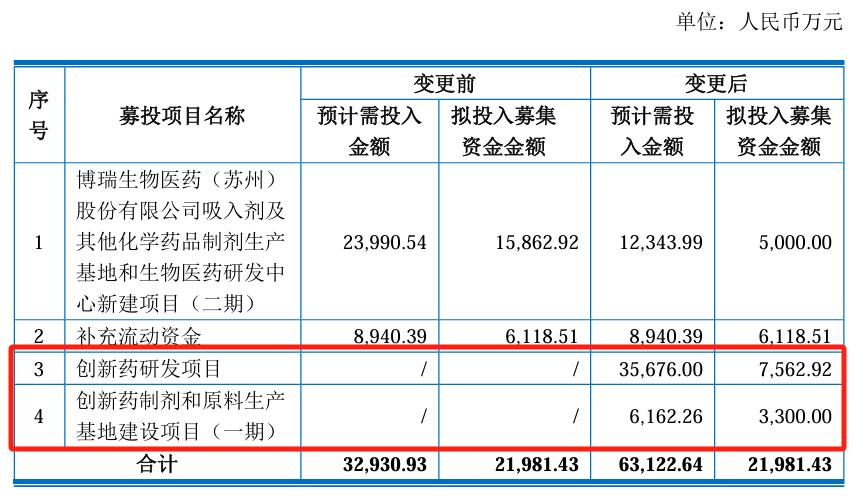

More striking operation is, in November 2022, medicine also made a secondary, raise money is about 2.198 billion yuan, the company announced to adjust the use of some investment plan, reduced the inhalant and other chemical preparation production base and research and development center investment scale, will shrink out 108.6 million money into GLP-1 innovative drug research and development and the construction of related production base.

But from the chairman of the "drug test" to promote their own GLP-1 pipeline and change the raised project funds, the future focus of Bo Rui medicine is shifting to "weight loss drugs", a little exaggerated by investors called "suo" ha ". Of course, this is a joke.

These operations seem to be carefully considered by the company.

Of course, this operation of the market funds are also quite paid, Bo Rui pharmaceutical shares on May 7 rose 7.25% to close at 35.5 yuan / share.

01、Why did Bo Rui Pharmaceutical embark on this road?

Borui Pharmaceutical is a high-end pharmaceutical enterprise with high barrier intermediates and API as the core. The reason for describing it with "high-end" is that the company focuses on the research and development of characteristic API, high-end chemical generic drugs and innovative drugs.

At present, Bo Rui Pharmaceutical has realized the coverage of the whole industry chain from the "API starter cGMP difficult intermediate characteristic API preparation products".

According to the company's financial report in 2023, the company achieved revenue of about 1.18 billion yuan, a year-on-year increase of 15.94%, deducting non-returnee net profit of 186 million yuan, a year-on-year decrease of 12.79%.

Among them, the revenue of API products was 885 million yuan, the revenue of preparation products was 138 million yuan, the overseas equity sharing revenue and technology revenue were 61.9034 million yuan and 75.8048 million yuan respectively. API products are still the core revenue source of Bo Rui Pharmaceutical, accounting for 75% of the total revenue.

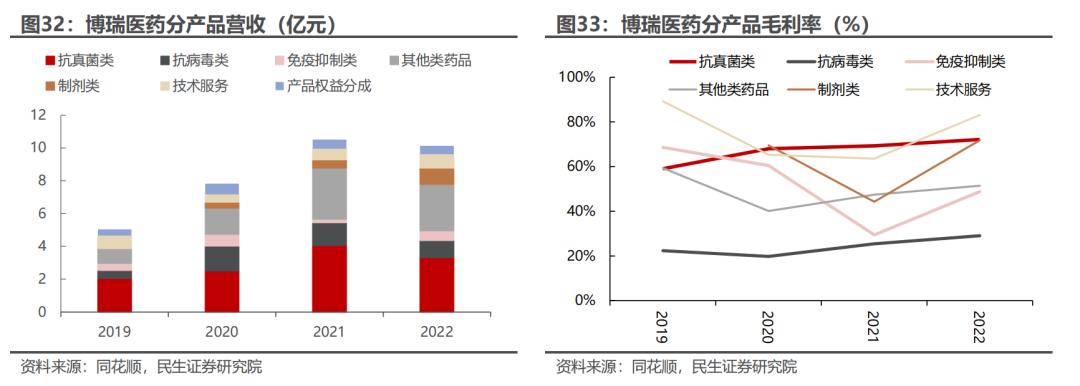

Looking at the financial data of Bo Rui Pharmaceutical in recent years, the trend of steady improvement in revenue and profit was shown before 2021. From 2021 to 2023, the company's revenue stagnated, and the profit end also fluctuated around the scale of 200 million yuan.

Especially in 2020-2021 (2020 is the first year of the commercialization of Borui Pharmaceutical preparations), the rapid volume of antifungal (such as caspofungin) and antiviral preparations (such as entecavir, etc.) was Borui after the launch, which drove the rapid growth of the revenue of the company's related API products.

After 2021, the revenue of the company's antiviral product entecavir API was affected by downstream demand fluctuations. Meanwhile, the price of antifungal products declined, and the revenue segmentation of the company's core API declined significantly.

The research and development of difficult generic drugs has certain barriers, which can promote the volume of preparation products through the expiration of the drug cliff and the first imitation, domestic substitution and collection policies, so as to achieve the rapid improvement of API. But this pattern to sustainable development, the difficulty may be "hell", industry enterprises must through continuous layout and rapid development a large number of generic drug pipeline implementation "alternate" new, the uncertainty of performance also comes from the upstream raw material periodic, downstream competition pattern deterioration and the demand atrophy.

On the other hand, as of April 12,2024, PE (TTM) of API sector is 28.14 times. API enterprises not only lack performance stability and business volume expansion, but also the general valuation of the market is not high.

Bo Rui Pharmaceutical Pharmaceutical is clearly aware of the problem.

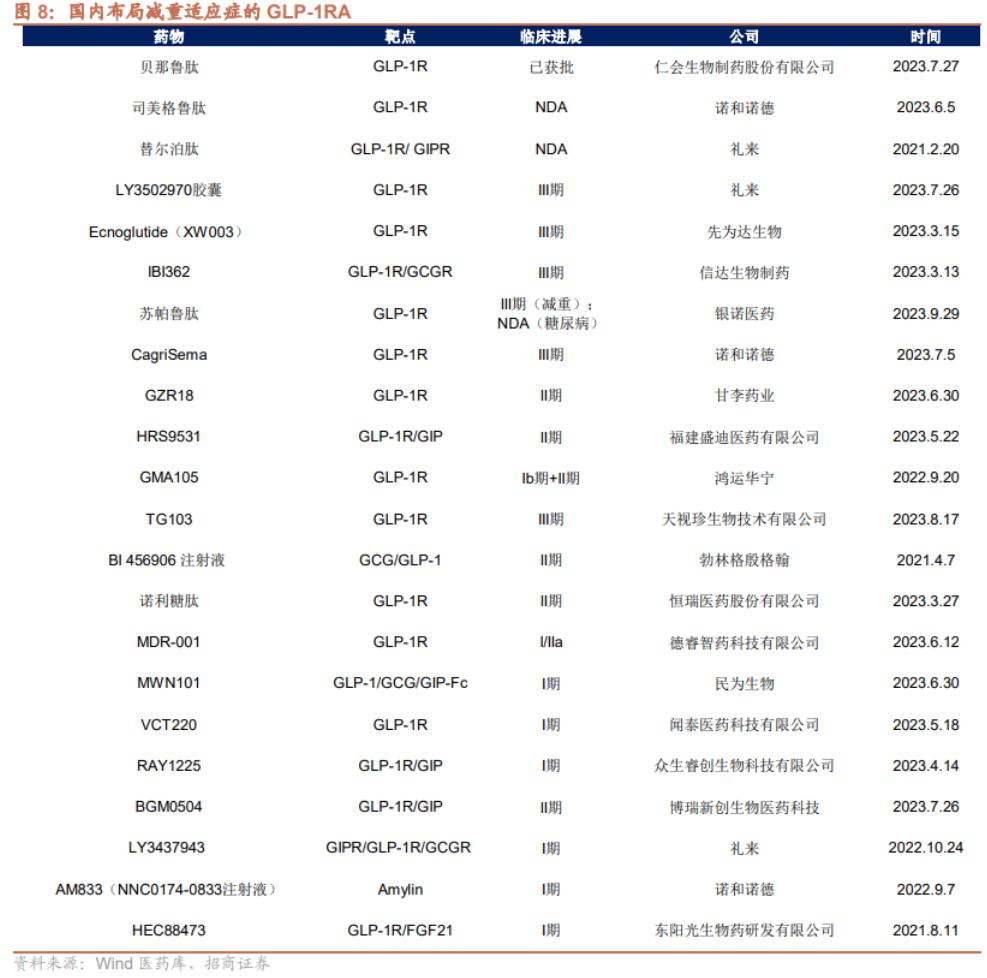

In the field of innovative medicine, the company built the coupling drug technology platform and YaoXie combination platform, not only has the peptide coupling drugs BGC0222 domestic rights and interests authorized to Suzhou tianma medicine, and the GLP-1 peptide hypoglycemic drugs BGM0504 injection to clinical phase ii, successfully become the domestic GLP-1 double target drugs in the first echelon leader.

Because of the progress of GLP-1 innovative drugs, the market capital once pushed the market value of Borui Pharmaceutical to around 20 billion yuan, and the company's static earnings ratio for 2023 is more than 100 times.

02、The "gold content" of the polypeptide industry

In addition to the "benefits" at the valuation level, the peptide field is also very attractive, which can be demonstrated from the aspects of competitive pattern, profitability and product.

At present, the number of domestic polypeptide enterprises is about hundreds, which seems to be very "red sea", but in fact, there are not many head enterprises with real core competitiveness.

Most of the core varieties of domestic polypeptide enterprises are primary raw materials with less than 10 amino acids, and high-end long-chain polypeptides rely on imports.

In China, most of the products of polypeptide preparation enterprises are almost polypeptide varieties whose patents have expired or have not applied for patents in China. The data in 2019 show that there are more than 55,19 and 19 active record enterprises such as thymus pentapeptide, somatostatin, octreotide acetate and other varieties, respectively, and the homogenization competition is fierce. However, it is worth noting that there are still few qualified domestic suppliers of some difficult generic API, such as carbectocin, leuprorelin, etibactide, atosiban acetate and other generic API suppliers are less than 5.

So for the small molecule difficult generic drug experience of the Bo Rui medicine for many years, into the polypeptide is not too late.

In the past five years, the gross profit margin of Bo Rui Pharmaceutical has fluctuated in the range of 54-58% for most of the time, and the profitability of polypeptide API and pharmaceutical products is higher than that of small molecule products.

Take Nuotai Biology as an example, its gross profit rate before 2022 (when the core segment of revenue was mainly small molecule customization business) was lower than 60%. With the increase of the business scale of independently selected products (peptide business), its gross profit rate increased to the level of more than 60%, and the gross profit rate in 2024Q1 further increased to more than 67%.

According to the management of Nortech, the increase in gross margin is mainly due to the high pricing of GLP-1 products, the gross margin is generally 70-80%, and the optimization of the company's production technology also has an impact.

From the example of Hanyu Pharmaceutical, another polypeptide enterprise, its core revenue mainly comes from polypeptide preparations and active substances. Before the core polypeptide preparations were affected by the collection, the overall gross profit rate of the company was generally above 75%, with strong profitability.

Finally, from the perspective of the products of polypeptides, the life cycle gap between small molecules and polypeptides is not large (the process barrier of polypeptide products is high and may be longer), but the collection is ultimately affected by the fate of scale. Bo Rui Pharmaceutical starts from its own GLP-1 innovative pharmaceutical products, and plans to build the production line (after completion, it can reach 350 million BGM0504). In the future, even if the product market share is not large, it can be involved in the field of polypeptide API and preparation, which is also a double guarantee.

03、aftertaste: BGM0504 how much market share can you grab?

As of the disclosure date of the annual report, GLP-1 / GIP inhibitor BGM0504 is in the second clinical phase, all the subjects in the injection of type 2 diabetes and weight loss indications have been completed, and all the subjects in the 5mg diabetes indication group have been discharged from the group, and the remaining case in the 10mg dose group has not been discharged.

Referring to the 24-week clinical endpoint setting of domestic GLP-1 weight loss drug phase II, it is expected that BGM0504 is expected to complete clinically by the end of 2024 or early 2025.

For phase III clinical completion of Cinda BioMars peptide, the main endpoint is 32 weeks and 48 weeks of data, that is to say, in the ideal case, the company needs to apply for listing at the end of 2025 or early 2026, and then another one year approval period, so the real commercialization needs to wait until 2027.

From the competition pattern within 3 years, the fastest GLP-1 dual-target domestic innovative drug, followed by Huadong Pharmaceutical; faster than the phase III GLP-1 molecule, Hengrui Pharmaceutical has just opened the phase III clinical of GLP-1 dual-target drug, and the competition pattern will be very fierce in 2027.

BGM0504 Can such GLP-1 dual-target drugs become a strong competitor in the future weight loss market?

A 100% positive answer cannot be given, but if you need to build a dimension reduction advantage, the drug must first be "better like", followed by competing production capacity (cost), patient compliance (half-life, injection convenience), etc.

BGM0504 At present, only the preliminary data of clinical phase 1a were disclosed, all adverse reactions were grade 1-2 in the range of 2.5-15mg, no side effects above grade 3, the exposure above equal dose of peptide (literature data), and linear proportional dose-response relationship, the mean body weight decreased by end-dose at 2.5-15mg dose (day 8 / 15).

However, in the United States, the GLP-1 dual-target agonist has felt the pressure, while the weight loss version of the peptide is expected to exceed $1 billion in sales by 2024 (the first full sales year); on the other hand, during an earnings call in early May, the management said that the company plans to lower its Wegovy price due to huge sales volume and fierce competition in the United States.

In view of the commercialization of BGM0504, there are domestic Cinda Biology, Henrui Pharmaceutical, East China Pharmaceutical and other giants occupied and compete on the same stage, then the commercialization prospects of BGM0504 is full of uncertainty, unless combined with domestic Pharam, perhaps can make up for the shortcomings of the company's commercialization ability.

epilogue:

In any case, the actual controller fully participates in the company's private placement, which really shows that the management is full of confidence in the future development of the company. However, the ability to cash or finally pay the money by the market investors (three years after the ban) may take Mr.Time to verify it.