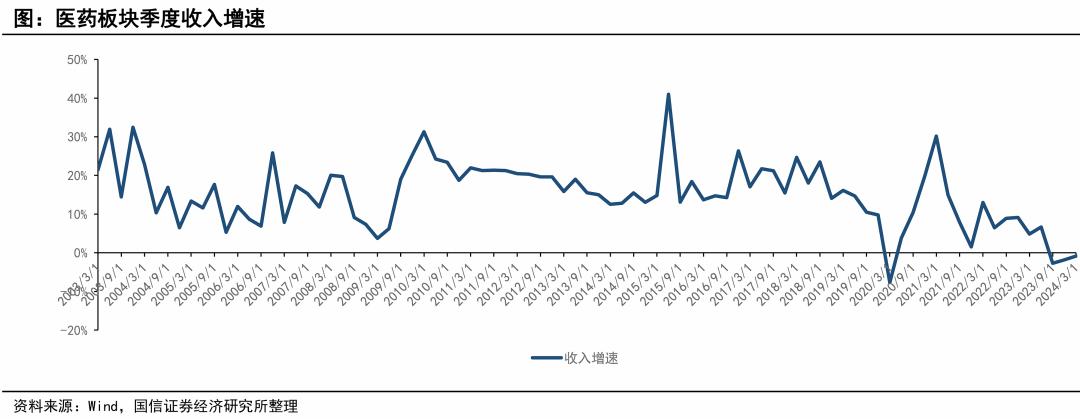

The pharmaceutical industry has experienced the longest cycle of negative growth in its history.

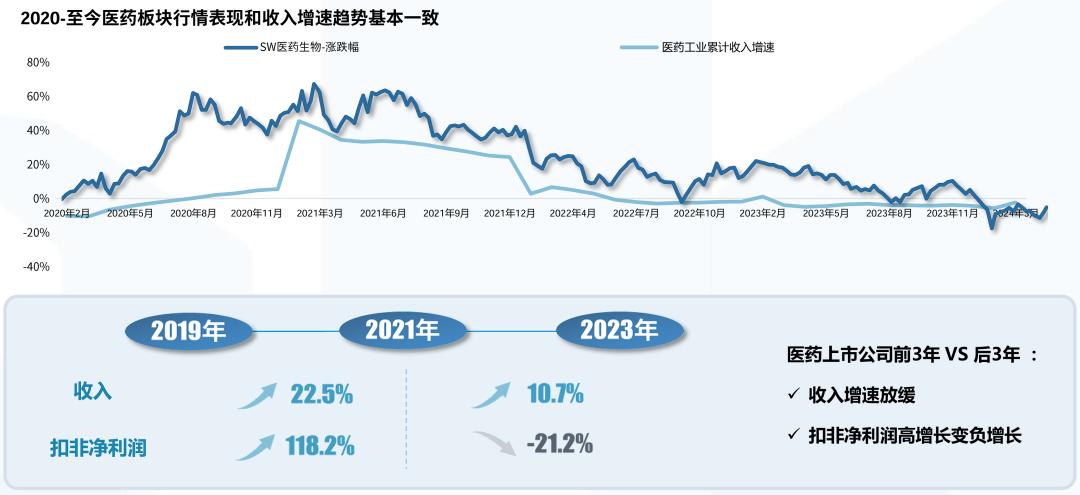

Since Q 32023, exhausted under multiple pressures, the listed pharmaceutical companies as a whole have been negative revenue growth for three consecutive quarters. From 2019 to 2023,5 years after centralized procurement implementation, the cost of drugs has been reduced by nearly 500 billion yuan, and the non-net profit of listed pharmaceutical companies has changed from high growth to negative growth.

The end of the long-termism of medicine?

Referring to Japan's experience, the domestic demand downward cycle, the main incremental space of enterprises in overseas. However, because of the geographical risks, our internationally competitive pharmaceutical companies are regarded as waste and abandoned, while those that are light on research and development and emphasize domestic demand are sought after.

Long-term will be reversed, must be based on international logic. Although the external relations are uncertain, but all roll domestic will only breakdown the floor, no lower limit. Comprehensive decoupling is impossible, and we should believe in the adaptive ability of Chinese innovative enterprises.

The internationalization logic began to map in the field of innovative drugs. Biotech broke through the triple blockade of investment, financing, commercialization and geopolitical risk through the large external BD of pipeline assets, and the evaluation system is accelerating to the overseas market (detailed analysis in the next period).

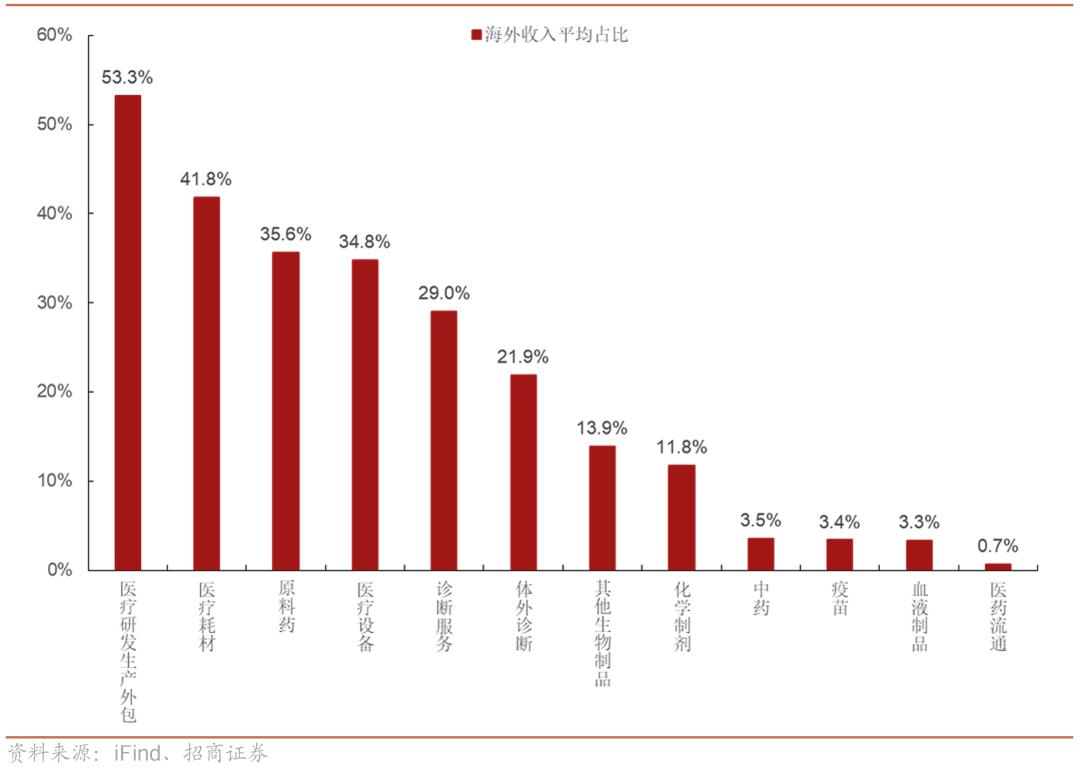

Pharmaceutical companies with a high proportion of overseas income in other fields are still severely suppressed for a while, but in the long term, a high proportion of overseas income is an absolute competitive advantage.

Internationalization is the long-termism of medicine.

sources: wind, National Bureau of Statistics, Guotai Junan Securities Research

01, centralized mining upgrade, directional blasting of large varieties

Since the "4 + 7" centralized drug procurement in December 2018,9 batches of 10 rounds of centralized procurement have been included in 374 varieties, only one step away from the target of 500 national and provincial centralized procurement of drugs, and the impact will be cleared?

But collective innovation on the road, big varieties nowhere to escape.

According to Dongguan securities, currently not included in the mining and meet five and more than 1 billion varieties have more than 30, including piperacillin, cephalosporins, norepinephrine, phenol, heparin injection, in the paprostat, sitagliptin, its valsartan, linagliptin, aspirin, acetyl cysteine, sevoflurane inhalants, such as lactulose oral fluid agent, etc.

In the second half of this year, the tenth batch of national mining will sweep these large varieties. If there is a fish that escapes the net, there will be the alternative drug alliance procurement led by Henan Province and the drug procurement for tumor and respiratory diseases conducted by Sanming Alliance.

Provincial alliances where conditions permit will upgrade them to national joint procurement, focusing on covering chemical drugs, proprietary Chinese medicines and traditional Chinese decoction pieces of traditional Chinese medicines that have not passed consistent evaluation, and focusing on "large varieties" of commonly used clinical drugs and consumables with large purchase amount and covering a wide range of people.

National mining and national joint mining will form cross firepower, clinical large varieties, no matter whether the evaluation, will not escape the fate of collective mining price reduction. According to the statistics of Yaozhi network, the sales of heparin products exceeded 10 billion yuan for the first time in 2021, among which low molecular weight heparin sodium and low molecular weight heparin calcium, no drug enterprises passed the consistency evaluation.

The alternative drug alliance procurement will cover the domestic uncollected products at high prices, and become a large variety of leakage price grinder. Alternative varieties is mainly did not enter the collection of drugs, including the original drug, not evaluation of drugs and other me too drugs, as early as the "4 + 7" after, all have different versions of alternative drug directory, its purpose is to prevent the selected varieties after price, some of the same type, in clinical substitution drugs for replacement. It may be impossible to prevent, this time the alternative drug list directly into the collection.

The national joint procurement of tumor and respiratory drugs, breaking the previous mode of bidding according to the general name dimension, belongs to the first batch of centralized procurement by disease type, which is seamlessly connected with the reform of DRG / DIP payment method. The tumor field is the basic plate of innovative pharmaceutical enterprises, with large varieties. The collection may affect the peak sales and life cycle of core products of innovative pharmaceutical enterprises.

Full coverage of large varieties, the key is to see the price reduction. At present, there is no stable expectation of the collection scale. The renewal of insulin procurement is moderate, but on the basis of the average price reduction of 82% in the first round of artificial procurement, the average price reduction of continuous procurement is about 6%, which is too strong for orthopedic enterprises to slow down and reach the bottom out again.

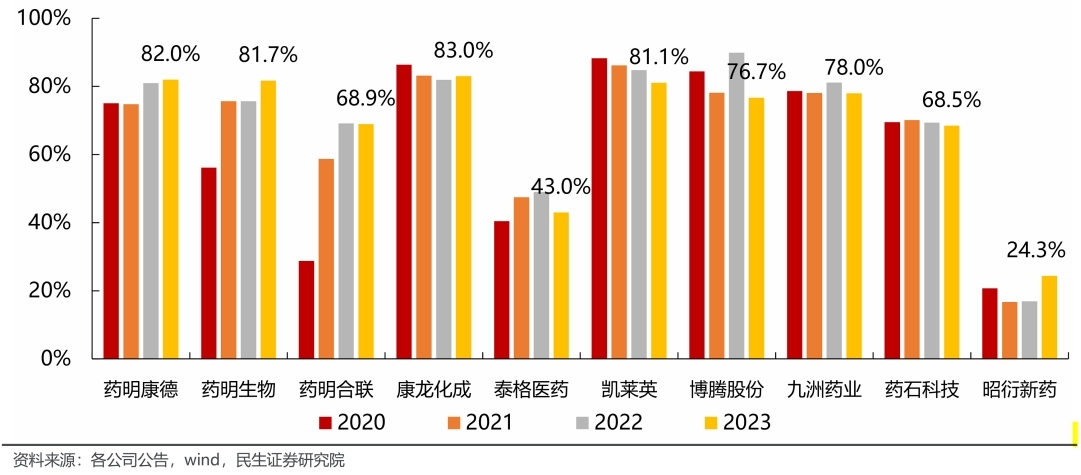

Proportion of overseas income of Chinese CXO enterprises from 2020 to 2023

02. The proportion of overseas revenue is positively correlated with the stock price

Don't ignore the Japanese experience.

Under the double blow of MNC's occupation of local market share and medical insurance cost control, Japanese pharmaceutical and equipment enterprises were under pressure and forced to go overseas.

According to the statistics of Haitong Securities, from 1989 to 2003, the actual annualized growth rate of Japan's export amount reached 4.1%, higher than the annualized GDP growth rate of 1.1%, which is the main contribution to the economy. Among the more than 430 Japanese listed companies that disclosed their overseas revenue, 1992Q3-2003Q1, the enterprises with annual rise and fall of more than 10%, 0-10% and less than 0%, whose average overseas revenue accounted for 53.5%, 46.7% and 34.8% respectively, indicating that there is a strong positive correlation between the overseas revenue ratio and the rise and fall of the stock price. External demand provides support for performance, and the market performance is often better.

Excluding the proportion of revenue, there is an interesting conclusion that the industries with better market performance have more diversified regional sources of overseas revenue. Precision instruments and electrical machinery industry, its revenue from North America, Asia, Europe accounted for a relatively uniform proportion, to a certain extent, the risk diversification, can guarantee stable performance. In the steel and textile industries, their exports are relatively weak. Japanese steel companies get 57.6 percent of their revenue from the United States, while 74.1 percent of their revenue comes from other Asian countries.

In fiscal year 1997, the operating income of Japanese overseas subsidiaries accounted for 37.5% of the revenue of the head office. By the fiscal year 2020, the operating income of overseas subsidiaries had reached 69.3% of the operating income of the head office, accounting for nearly doubling.

Nowadays, the geopolitical relationship is more complex, but the starting point of our enterprises is higher than that of Japanese enterprises. The key is to adapt to the new situation.

In 2023, more than 70% of the revenue of domestic top CDMO enterprises comes from overseas markets, and the overseas revenue growth rate of Wuxi Apptec, Pharmaceutical Biology, Pharmaron and Zhaoyan is higher than that of domestic revenue.

In 2024Q1, the global biomedical investment and financing amount was us $47.07 billion, the second highest quarterly data since 2011, with a year-on-year growth of 257% and a sequential growth of 118%. The recovery of overseas demand can partially offset the impact of MNC transfer capacity. In Q 1 of 2024, Wuxi Apptec added more than 300 new customers, and the new signed orders of Kanglong Chemical increased by more than 20%. The coverage rate of inquiry index, new signed orders, existing orders in hand, orders and target revenue all showed a positive growth state.

MNC is not completely decoupled from China CXO, but reduces supply chain risks and distributes capacity among regions. Drawing on the experience of these Japanese companies, CXO should also promote the diversification of overseas revenue sources. Europe has become the fastest growing market for the four CXO giants. WuXi Apptec 2024Q1, revenue from European customers increased by 3.9% year on year, European market revenue in 2023 increased by 101.9%, accounting for 30.2% of corporate revenue (2022), revenue from European customers increased by 57.11% in 2023, and by 24.35% in 2023. The proportion of long-tail customers with low correlation with geographical policies increased. In 2023, the revenue from small and medium-sized customers increased by 11.96% year on year, accounting for 85.07% of the operating revenue. In 2024Q1, the revenue from small and medium-sized pharmaceutical companies was 918 million yuan, accounting for 65.57% of the revenue (36.26% in 2023).

In 2024Q1, CXO strengthened their response to decoupling, increased global BD expansion and customer access, increased sales expenses, and actively arranged ADC, polypeptides, polypeptides and synthetic biology, and increased research and development expenses.

According to the statistics of Minsheng Securities, compared with the leading foreign companies, China still has some room for improvement. In 2023, the per capita income of Wuxi Kant, Pharmaceutical Biology, Jiuzhou Pharmaceutical and Zhaoyan New Drug will exceed or approach 1 million yuan, and the per capita income of overseas CXO is generally in the range of 1-3 million yuan, among which Samsung Biology is 4.604 million yuan.

Medical device industry entering the overseas market harvest period data source: Wind, Guotai Junan Securities Research

Beyond the Japanese company Termao

Japanese equipment company precision manufacturing capacity is strong, going overseas to help the second growth.

Shizonkang is a world-famous IVD product manufacturer. Its overseas revenue accounted for 68% in 2010 and increased to 83% in 2017. Asahi Yingda is a world-renowned guide catheter manufacturer. Its overseas revenue accounted for 41% in 2012 and increased to 82% in 2023. From the beginning of 2010 to the beginning of 2024, Xison Meikang increased 6 times, Asahi Yingda 30 times, and Nikkei 2502.4 times in the same period. Globalization has brought excess profits to Japanese equipment enterprises. Telmao is a multinational medical device giant. In 2006, Telmao's overseas revenue accounted for 40%, and increased to 75% in 2022. The stock price increased by more than 20 times.

Medical devices belong to high-end manufacturing, which is also the field that Chinese people are good at. The application level is more important than basic research, tool rationality is greater than overhead imagination, imitation and improvement step by step, and increasingly excellent, and strong ability to control costs.

The new air outlet of direct overtaking overseas manufacturers has arrived (see "Digital Intelligence Transformation, Mindray Straight Overtaking" for details). The underlying technology upgrading potential of most medical device products is relatively limited, and the r & d investment direction of the world's leading manufacturers is mainly the development of new technology products and digital integration. Innovative equipment is intelligent and integrated, which is also what domestic enterprises are good at.

According to guosen securities, domestic medical equipment in clinical accumulated data value, will accelerate its technology evolution, such as medical imaging equipment of medical image data (X-ray, CT, MRI, ultrasound, endoscopy, optics, images), medical electronic equipment of physiological parameters data (such as ecg, EEG, blood pressure, noninvasive blood sugar waveform data), in vitro diagnostic equipment data (such as pathology, microscopy, all kinds of test, etc.).

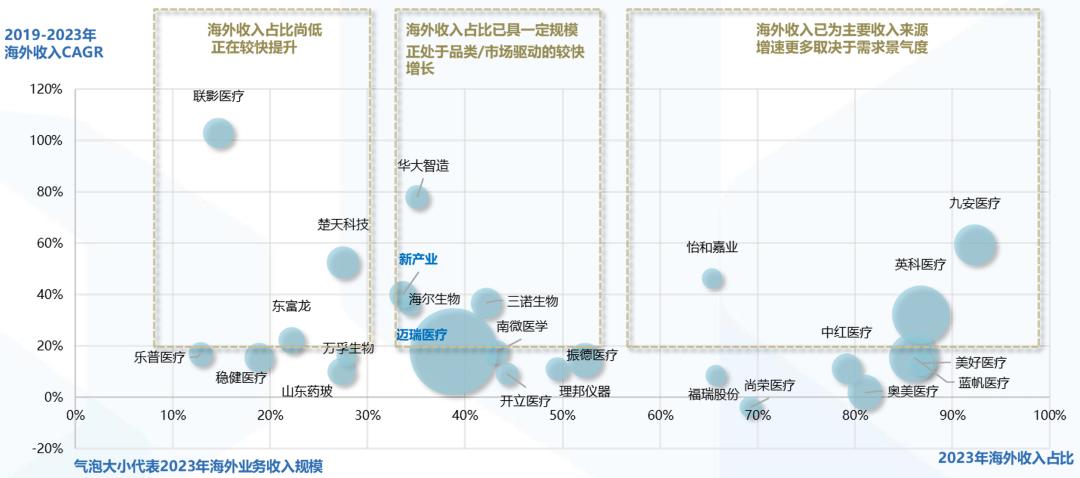

In 2023, equipment enterprises accounting for more than 50% of overseas revenue will focus on low-value consumables (Inke Medical, Zhende Medical, Gudong Medical), upstream supply chain / OEM enterprises (Beautiful Medical, Haitai Xinguang) and a small number of IVD companies. The growth rate depends more on the demand boom.

Overseas revenue accounting for less than 50% is actually a sweet area. The types of enterprises whose overseas revenue accounts for 30-50% and maintain rapid growth are mainly high value-added high value consumables (Southern Medical), medical equipment (Mindray Medical, Open Medical) and IVD (New Industries, irui Medical). Most companies are concentrated in 0-20% of the overseas revenue, but the innovation ability is strong, present a higher than 50% year-on-year growth, such as eye leading love bo medical, orthopedic leading big medical / spring health, IVD leading Ann biological, electrophysiological leading HuiTai medical / micro electrophysiology, aortic intervention leading heart medical, medical image leading shadow medical treatment.

Medical devices are not cutting-edge technology, far from geopolitics and belong to the category of trade friction and can be negotiated. The EU has set a buffer in all aspects of initiation, suspension and withdrawal. Domestic devices take the initiative to diversify their overseas destinations and increase market diversification. In 2023, China's export of medical devices to the "Belt and Road" market was 13.248 billion US dollars, accounting for 29.10% of the overseas market, 4.8 percentage points higher than that in 2022. The export amount to the United States and some developed countries (Britain, Germany, Japan and South Korea) accounted for 41% of the overseas market, and the cumulative export proportion of the top ten export markets decreased from 62.35% in 2018 to 56.5%.

It is believed that the leading domestic equipment enterprises led by Mindray Medical will surpass Termao for a long time.

We may not realize that we have a number of internationally competitive pharmaceutical companies, we should not belittle ourselves and dwarfing ourselves. To give the years with civilization, the long-termism of medicine will eventually be realized.