foreword

At the 2024 China Automotive Chongqing Forum, which opened on June 6, BYD, GAC, Geely and many other domestic auto leaders launched a heated discussion on the current "internalization" phenomenon in the auto industry, which triggered social media. And this kind of "inner volume" has been repeatedly staged in the medical circle, medical people have long been used to, and even some entrepreneurs shouted out "only the volume shows that the market is good", "only the volume can appear true king". At present, the most popular drug in the pharmaceutical industry is GLP-1, which has two nearly trillion-level markets: diabetes and weight loss. Novo Nordisk and Eli Lilly are trying their best to expand the production capacity of simegallutide and telbase peptide, but the demand is still in short supply. With the simeeogluotide patent about to expire in 2026, a wave of generic drug companies will enter the track, and GLP-1 drugs are bound to surge sharply. While the development of GLP-1 polypeptide drugs is in full swing, the upstream raw material market has already entered the stage of white-hot competition. This paper will organize and analyze the upstream raw material market of GLP-1 drugs, hoping to inspire you.

The GLP-1 drug-led industrial chain is booming

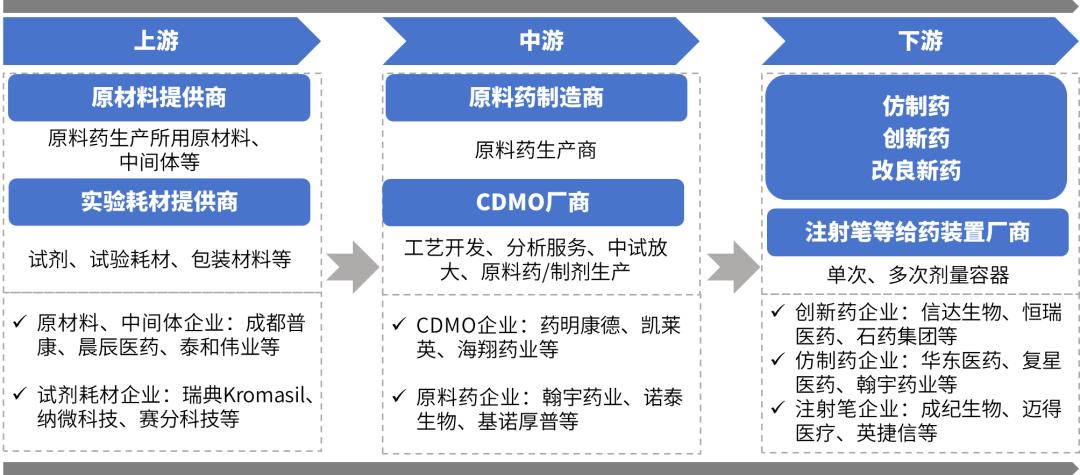

At present, the domestic polypeptide drug industry chain has been well developed, which can be divided into upstream raw materials and reagent consumables, midstream peptide API and CDMO companies, and downstream peptide drug research and development and drug delivery device enterprises. The general situation is shown in the figure below.

Upstream raw material cost is high, competition volume a new height, each enterprise show their talents.

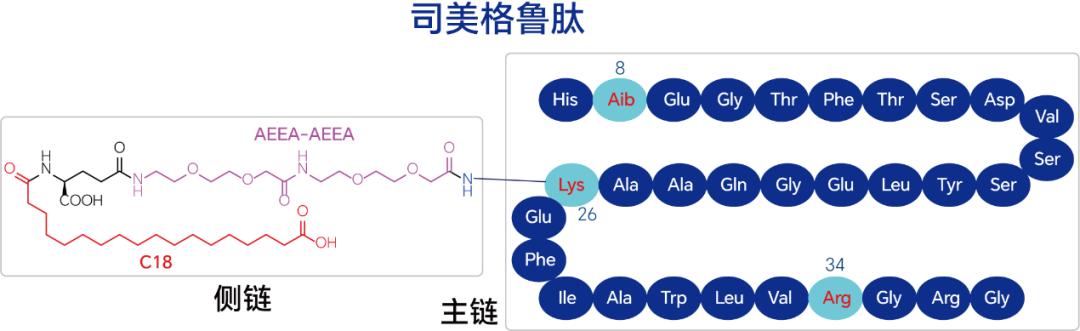

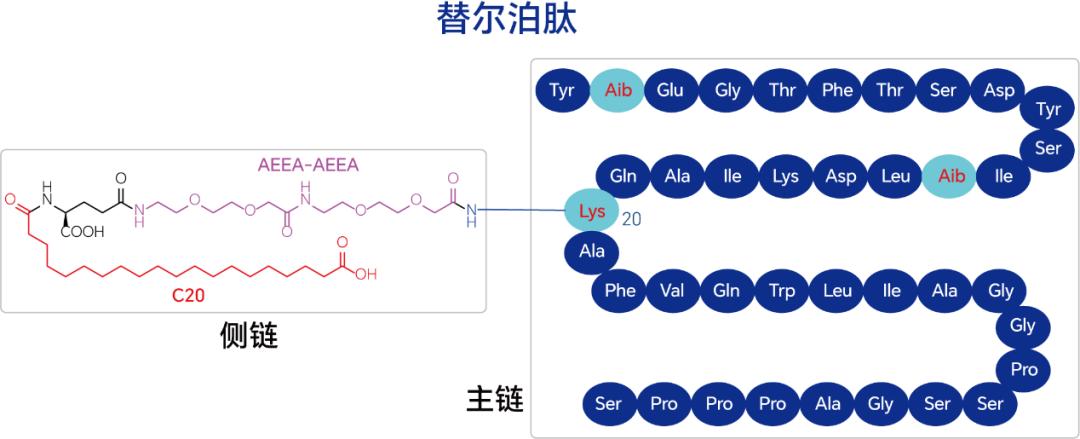

As can be seen from the structure of sermelutide and park peptide, these drugs are divided into main chain and fatty acid side chain. The main chain is composed of amino acids (containing non-natural amino acid Aib), and the fatty acid side chain is composed of a long chain of saturated fatty acids (C18, C20) and AEEA. Fatty acid side chains and related amino acid fragments are important raw materials for the production of GLP-1 polypeptide drugs. In addition, both the fermentation process and the synthesis process produce GLP-1 drug substance, so the chromatographic packing is also an important raw material for the production of GLP-1 drug substance.

Structure of selmeaglutide and tilporpeptide

In order to occupy the market, raw material manufacturers in addition to the volume price, but also in the quality, production capacity, supporting services and other aspects of all rolled up!

1. Volume price:

In order to seize the market share, the raw material manufacturers in the price to kill the red eye. The fatty acid side chain dropped from more than 500,000 yuan per kilogram to tens of thousands of pieces per kilogram. The price of cabbage and some domestic packing fell to ten thousand yuan per kilogram. There is an interesting phenomenon that some GLP-1 API companies chose self-research and self-production side chain because of the expensive price of side chain. However, today, both the quality and cost is inferior to the purchased side chain, so they give up self-production and turn to purchase.

2. Volume quality and supporting quality research services:

Two years ago, the purity of protected amino acids and fatty acid side chains of greater than 98% was high purity products. Nowadays, the quality is better than one. Whether protecting amino acid or fatty acid side chain, suppliers have achieved the same quality as the small molecule API of chemical drugs, and the single miscellaneous energy is controlled below 0.1%. In addition to the continuous improvement of quality, a number of manufacturers have also launched supporting quality research services, which can help customers to carry out the quality research work related to raw materials involved in the GLP-1 drug CMC research.

3. Volume capacity:

Novo Nordisk and Eli Lilly have been expanding their production capacity with the volume of GLP-1 drugs. Nordnodisk has invested tens of billions of dollars to expand production facilities in France, Denmark and the United States, while Lilly has extensively expanded production facilities in Germany and the United States. In the same logic, capacity is the focus of current generic GLP-1 drug manufacturers when choosing raw material suppliers. Therefore, in recent years, various raw material manufacturers have invested or financed to expand production, and constantly enlarge the corresponding product production batch. From the market research, it is true that there are also some raw material production enterprises that entered the bureau earlier and have lost the pioneering advantage due to insufficient production capacity and too small batch volume.

Development situation of polypeptide pharmaceutical raw material industry

01, fatty acid side chain profile and representative manufacturers

The fatty acid side chain is difficult for synthesis, separation, purification and quality research, and the price is also high. The side chain accounts for a high proportion of the cost of the whole GLP-1 drug, which is also the most important part of the middle and downstream API, generic drugs and new drug manufacturers.

Chengdu Pukang Biotechnology Co., Ltd. is one of the earliest companies to enter the side chain development of polypeptide drugs in China. In the early stage, it provided the fatty acid side chain used by liraglutide and insulin degu, and later provided fatty acid side chain intermediates for simegallutide and telporpeptide. As the earliest supplier of fatty acid side chain, Chengdu Pukang is also the first batch of enterprises to eat industry dividends, and has been recognized in the capital market. In June 2024, Chengdu Pukang announced the completion of hundreds of millions of yuan of financing. As a pioneer, the first-mover advantage is obvious, but it has also become a clear competitive target of other fatty acid side chain suppliers, and the market pressure is not small.

In addition to Chengdu Pukang, the author recently visited a peptide enterprise and found another company with high visibility- -Changsha Chenchen Medical Technology Co., Ltd. A number of industry friends expressed their appreciation for their products and technologies. Founded at the end of 2019, Chenchen Pharmaceutical, a typical technology-based entrepreneurial team, has achieved annual sales of hundreds of millions of yuan by CRO business and GLP-1 raw materials in just a few years. It has built a high-level RESEARCH and development platform purely by its own ability, and invested more than 100 million yuan in research and development of instruments. Chenchen Pharmaceutical is also favored by investment institutions. In September 2023, it completed the first round of financing of more than 100 million yuan in September 2023, and built a 50 mu GMP synthesis factory in Yueyang, Hunan Province. Although Chenchen Pharmaceutical entered the GLP-1 track late, but has made advantages in product quality, price, supporting services and other aspects, the latecomer ranks on the top, and has occupied a lot of domestic market share.

In addition to Chenchen medicine, the new GLP-1 side chain track and Xiamen Sanobang, Anhui Nuoquan, Lingkai medicine and many other enterprises, and all aggressive, are ambitious, but the strength still needs to experience the test of the market. The entry of new players also indicates that the competition will become more brutal, so let's wait and see who will be the final winner and take the lead.

02, amino acid profile and representative manufacturers

For the synthetic process manufacturers, amino acid is a basic raw material; manufacturers using fermentation process, also need some amino acid products. Although the price of amino acid is low, as the main raw material of GLP-1 polypeptide drug, the relevant manufacturers are favored with capital. Chengdu Taihe Weiye Biotechnology Co., Ltd. has achieved a total financing of 500 million yuan in half a year, which shows the importance that the capital attaches to GLP-1 raw materials. After obtaining capital support, Taihe Weiye immediately lowered the price of amino acids, trying to further seize the market and stabilize the market position. Obviously, Taihe Weiye decided to exchange profit margin for market share, and the price war of amino acids officially started.

In addition to Taihe Weiye, there are also a number of amino acid enterprises, such as Sichuan Sanmao Biochemical, Sichuan Tongsheng Amino acid, Jill Biochemical, Sichuan Jiaying Lai and so on. As a traditional chemical products, amino acids have relatively low technical barriers, and most manufacturers have large production capacity and customers are relatively stable, so it is difficult to have new players to join the competition, but the existing amino acid manufacturers are still facing severe competition situation.

03, domestic chromatographic packing profile and representative manufacturers

Due to the early start of overseas companies, the domestic chromatographic packing market was dominated by overseas brands in the early stage, among which Kromasil packing once had an absolute dominant position in the field of separation of insulin and polypeptide. In recent 10 years, however, with the domestic insulin, GLP-1 drugs, small nucleic acid drugs such as vigorous development, has a huge demand for packing market, and has a clear authors demand, various companies have said Kromasil product is too expensive, this brings great opportunities to domestic packing enterprises, many domestic chromatographic packing companies have grown up, but also lead to domestic packing market abnormal volume, have kill red eyes.

Suzhou Nawei Technology Co., Ltd. was established in 2007, experienced a long and difficult period, is a typical technology research company, finally through continuous research and development investment to make the products better and better, gradually obtained the market recognition, is the first domestic packing company to truly break the monopoly situation of imported products. NMicro Technology ushered in a brilliant moment in 2021, successfully listed in the science and innovation edition, with a market value of over 50 billion yuan and 50 billion yuan. NMicro now has a rich packing pipeline and is actively layout the GLP-1 market. In October 2023, it released a special packing for GLP-1 separation, and the market reaction is positive.

Suzhou Sai Branch Technology Co., Ltd. was founded in Suzhou in 2009, but the initial technology research and development began in 2002, lasting more than 20 years. Saifen Technology also developed after a long period of persistence, and finally passed the IPO of the science and Technology Innovation Board on January 11 this year. Sfen Technology also actively layout the GLP-1 market and launched a series of purification solutions based on its own products.

In addition to the two companies of Na Technology and Saifen Technology, there are many domestic packing companies, including Boyun Biology, Bogron, Huiyan Biology, Huapu, Guangzhou Weichun, Shanghai Yuexu, etc., and are actively participating in the competition of GLP-1 separation market. The emergence of many domestic packing companies is a good thing for the chromatographic packing to completely get rid of the import dependence, but the resulting internal volume is a test for the survival of the participating enterprises.

epilogue

GLP-1 drug as a popular fried chicken, is bound to attract more manufacturers to fight. In addition to the several companies mentioned above, other new companies do not know which competition will be promoted to a new level, we will wait and see. Finally, Wang Chuanfu, president of BYD, was quoted as sharing with all raw material suppliers: in fact, the essence of "volume" is competition, and the core of the market economy is that "only competition can produce prosperity".